DeFi

Dec 18, 2024

DeFi

DeFi

The past year saw several high profile token launches in the crypto space, but none have achieved the level of success or generated as much excitement as Hyperliquid’s HYPE token. HYPE conducted its airdrop and official launch in the final week of November before pulling in hundreds of millions in liquidity, backed by stablecoin. This article explores the Hyperliquid ecosystem with a particular focus on the vault mechanism which was responsible for its massive success.

Read more about the Hyperliquid launch

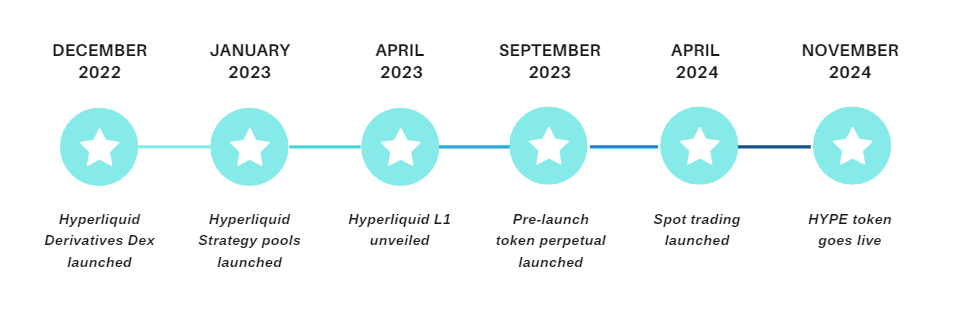

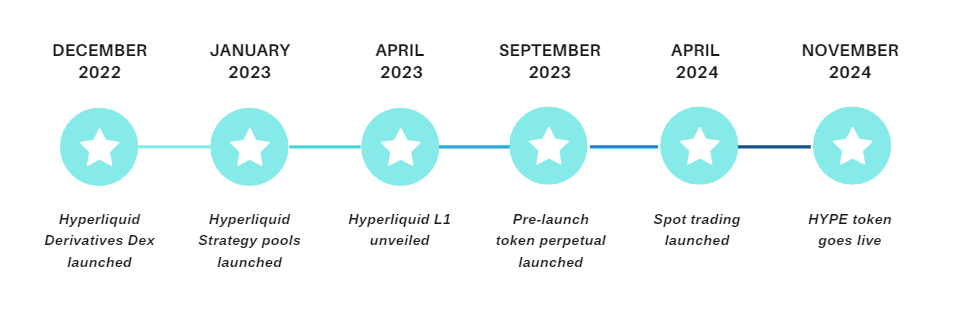

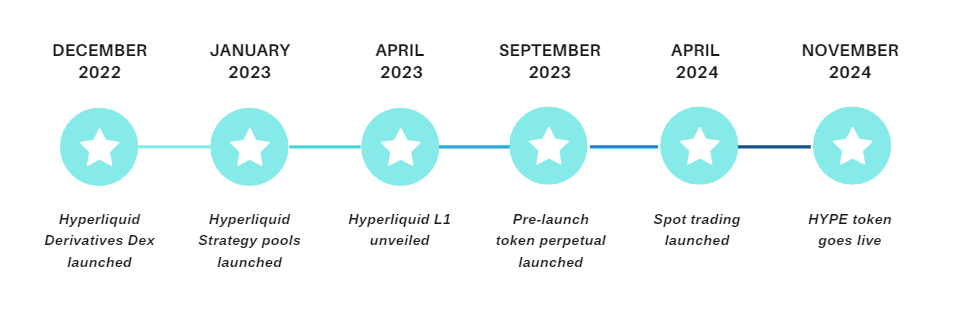

Hyperliquid was co-founded by Jeff Yan, a Harvard graduate with a background in quantitative trading. The core team members come from some of the top U.S. universities, including Harvard, MIT, and Caltech, many of whom had previous experience in high-frequency trading and quantitative finance.

Hyperliquid was bootstrapped by the team and this soon became one of its unique selling points at a time where most projects had large VC stakes. Lack of a large VCs meant that Hyperliquid could allocate a larger portoin of its tokens to the community which increased the community allotment and helped build loyalty over the brand.

The project launched its token in November 2024 and has been widely considered to be one of the best airdrops of this cycle. HYPE token currently trades at $28 and has a market cap of $9.3 billion and a fully diluted value of $28 billion.

Additionally, the Hyperliquid platform eliminates gas fees for transactions, enhancing transaction speed and efficiency for users engaging in decentralized perpetual futures trading.

Hyperliquid is well-known as the largest derivatives dex in Web3. It offers a trading experience comparable to that of a centralized exchange, featuring over 150 perpetual trading pairs on its platform. However, Hyperliquid is more than just an exchange, it’s also an L1 chain that’s optimized from the ground up for lightning-fast onchain trading.

Ever since its launch in December 2022, the project witnessed strong growth, quickly becoming the preferred platform for many perpetual traders. It has consistently offered more token pairs and higher liquidity than any of its competitors. In the first week of December 2024, the exchange had nearly $44 billion in trading volume which is 6 times the volume of the second biggest derivatives dex.

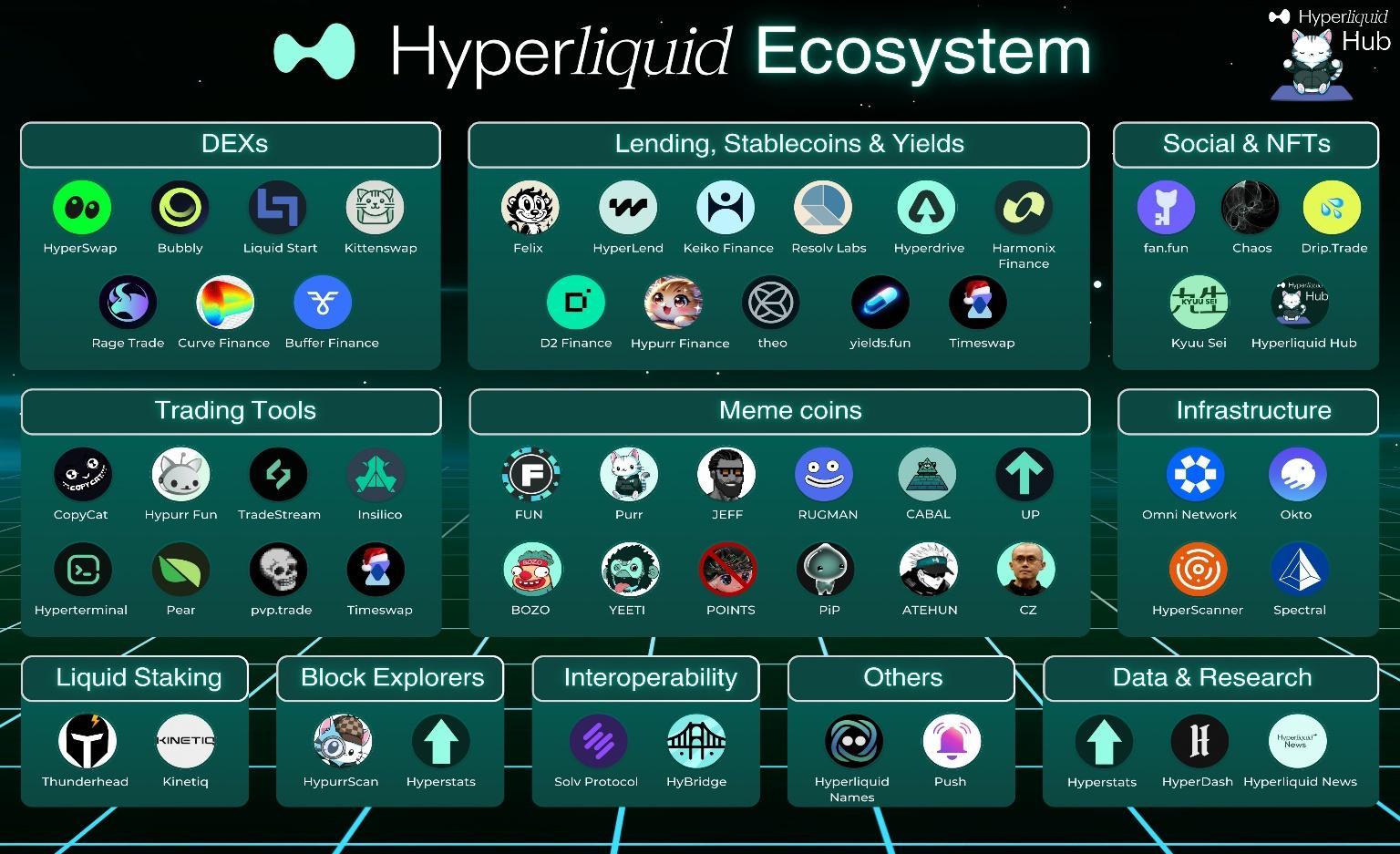

The Hyperliquid dex runs on the L1 chain with the same name. The Hyperliquid chain was built on Tendermint and supports over 100,000 transactions per second with a latency of less than 1 second. According to the Hyperliquid team, the L1 is capable of supporting an entire ecosystem of permissionless financial applications where every order, trade, and liquidation happens transparently on-chain. With such impressive stats, it’s no surprise that the chain has quickly built a thriving community of different financial platforms. The ecosystem includes user-built applications designed to interface seamlessly with native components, enhancing performance and user experience.

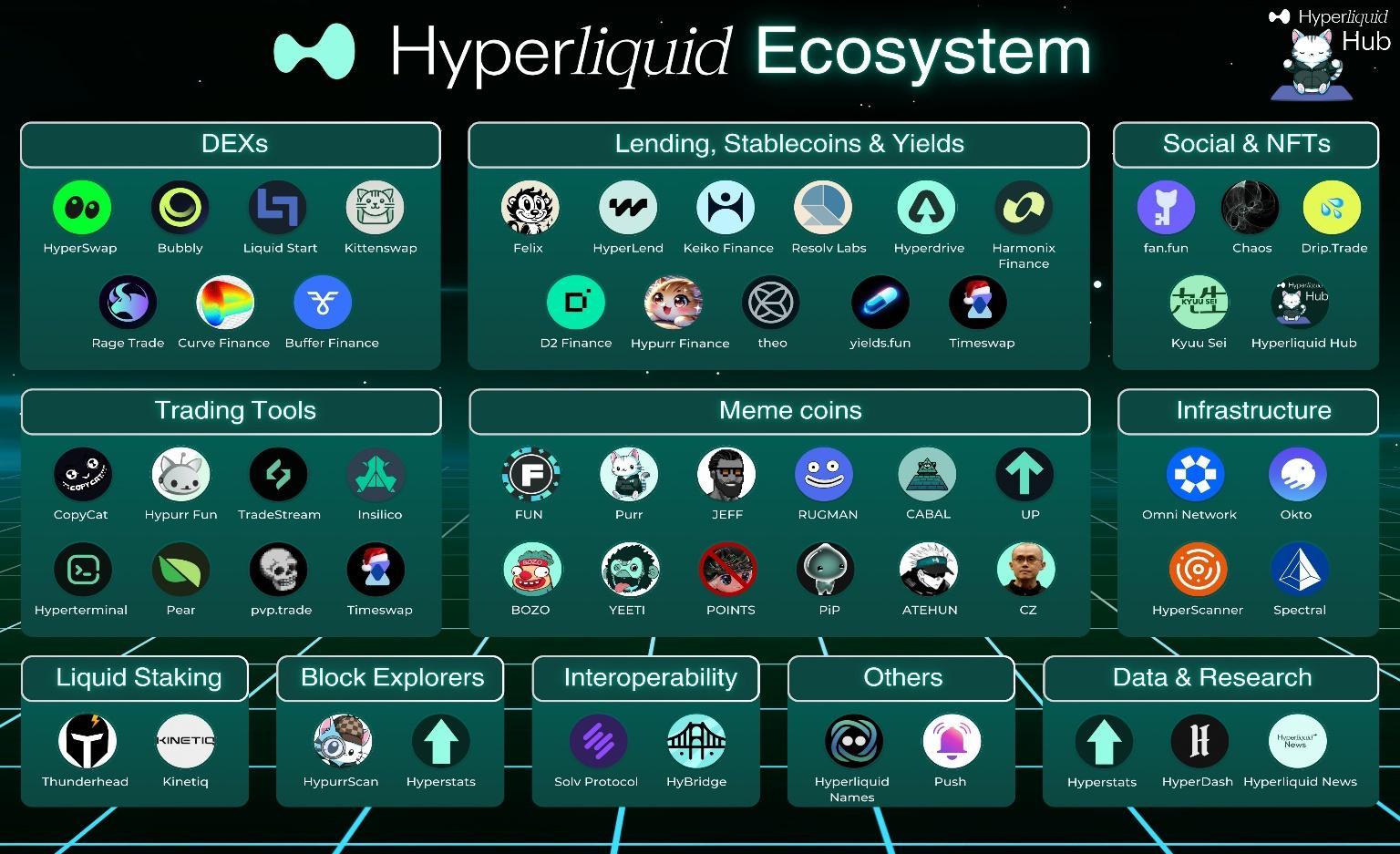

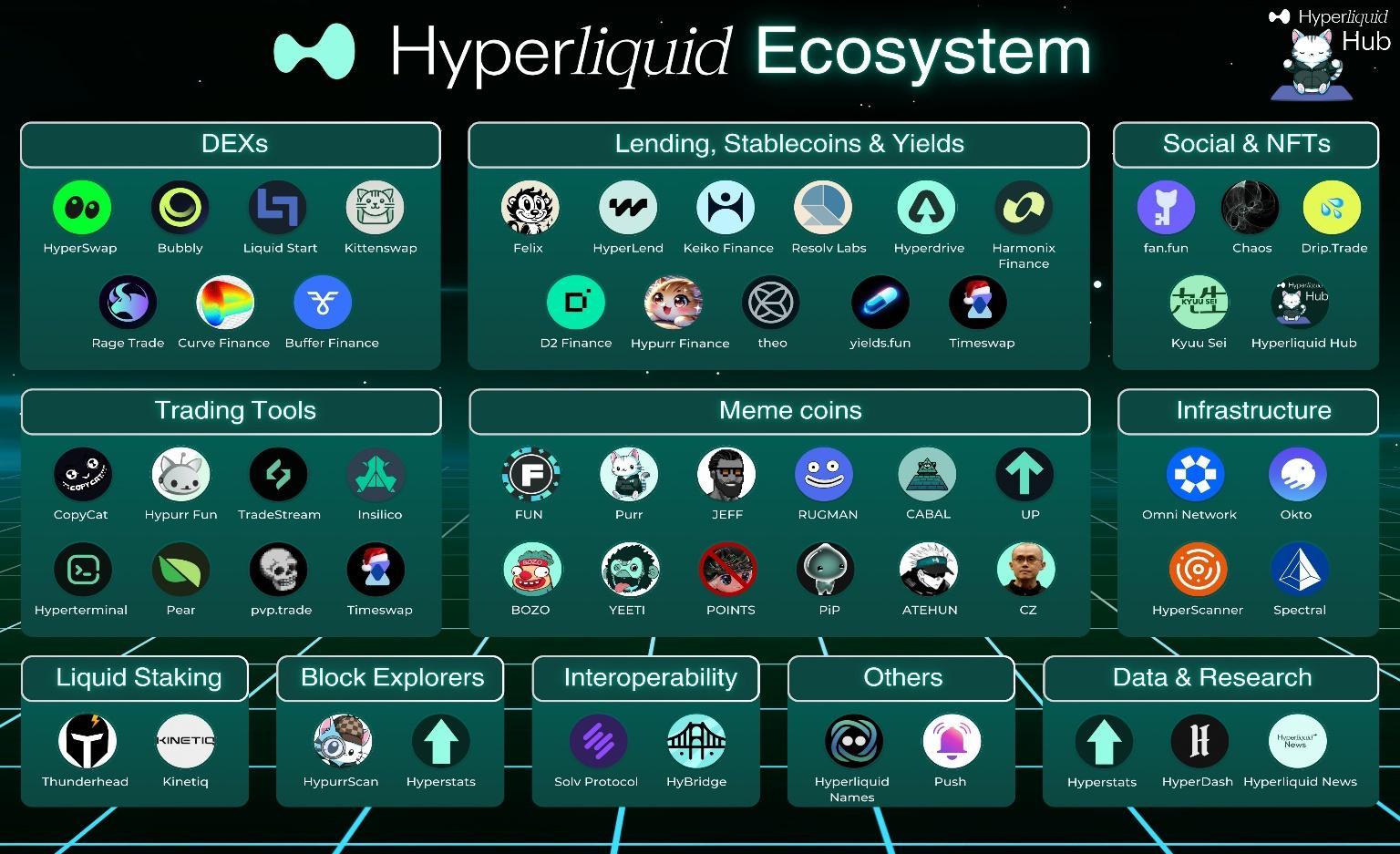

Source: Hyperliquid_Hub

The ecosystem currently includes multiple Dexes, lending platforms, infra projects, stablecoins, and even memecoins. At the time of this writing, there are nearly 20 different projects that are part of the Hyperliquid ecosystem and more are likely to join in the future.

Bridging to the Hyperliquid chain is a strightforward and seamless process. Currently, the chain supports the USDC token, which can be bridged from the Arbitrum network. Since deposits happen from Arbitrum, the transaction fees for bridging into and out of the Hyperliquid chain are exceptionally low, making it a cost-efficient option for users. The range of supported assets and chains are likely to expand in the future.

Hyperliquid’s custom consensus algorithm, HyperBFT, is a cornerstone of its robust and high-performance blockchain. Inspired by Hotstuff and its successors, HyperBFT is meticulously designed to provide rapid transaction finality and unparalleled security. This proprietary consensus algorithm ensures that every transaction on the Hyperliquid network is processed swiftly and securely, making it a reliable choice for users.

HyperBFT achieves several critical security goals:

Rapid Transaction Finality: Transactions are finalized quickly, minimizing the risk of forks and enhancing the overall security of the network.

Robust Security: The algorithm is fortified against various types of attacks, including 51% attacks and Sybil attacks, ensuring the network’s integrity.

High Performance: Optimized for high performance, HyperBFT supports fast transaction processing and scalability, accommodating a growing number of users and transactions.

In addition to the consensus algorithm, Hyperliquid employs a trusted validator set to participate in the consensus process, further ensuring the network’s integrity. Advanced cryptographic techniques secure all transactions, protecting user data and preventing unauthorized access. This combination of a custom consensus algorithm and stringent security measures makes Hyperliquid a secure and reliable platform for all its users.

Hyperliquid’s tokenomics are strategically designed to foster user participation and network growth. The HYPE token, the native cryptocurrency of the Hyperliquid network, plays a pivotal role in this ecosystem.

Circulating Supply: With a circulating supply of 330 million and a maximum supply of 1 billion tokens, HYPE is structured to balance availability and value.

Token Distribution: HYPE tokens are distributed through various channels, including staking, trading, and governance participation, ensuring widespread user engagement.

Staking: Users can stake their HYPE tokens to participate in the network’s consensus process, earning rewards for their contributions.

Trading: HYPE tokens are actively traded on multiple cryptocurrency exchanges, providing liquidity and opportunities for users to buy and sell the token.

Governance: HYPE token holders have a voice in the network’s governance, voting on proposals and influencing the platform’s future direction.

The incentives for participating in the Hyperliquid network are compelling:

Rewards: Users earn rewards for staking, trading, and contributing to the platform’s growth, making participation financially attractive.

Discounts: Active participants receive discounts on transaction fees and other platform services, enhancing their trading experience.

Increased Security: By engaging in the consensus process, users help bolster the platform’s security, protecting their assets and the network as a whole.

These well-thought-out tokenomics and incentives ensure that users are not only motivated to join the Hyperliquid network but also to remain active and engaged, driving the platform’s continuous growth and success.

In order to better understand the Hyperledger ecosystem, let’s first take a look at its flagship product, the Hyperliquid derivatives exchange.

In 2022, the vast majority of crypto derivatives trading happened on centralized platforms. Even though there were decentralized alternatives like dYdX and GMX, most traders preferred centralized alternatives due to their speed and higher liquidity. However, the collapse of FTX in November of that year forced many traders to look for decentralized alternatives. It was during this crucial time that Hyperliquid launched its exchange and became an instant hit.

To simplify the process of understanding HYPE's value, Hyperliquid offers a USD converter hype tool that allows users to convert HYPE tokens into USD.

The exchange’s phenomenal success can be attributed to the new vault mechanism, which greatly improves liquidity on the exchange by acting as a decentralized market maker. This mechanism enabled Hyperliquid to list more tokens with better liquidity than any of its counterparts. With the vault mechanism, Hyperliquid quickly became the no. 1 perp. Dex by daily trading volume.

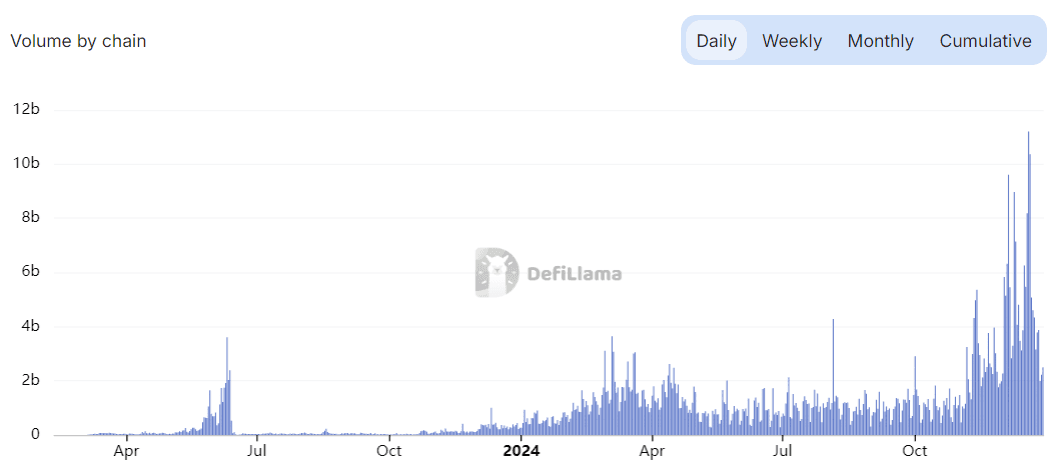

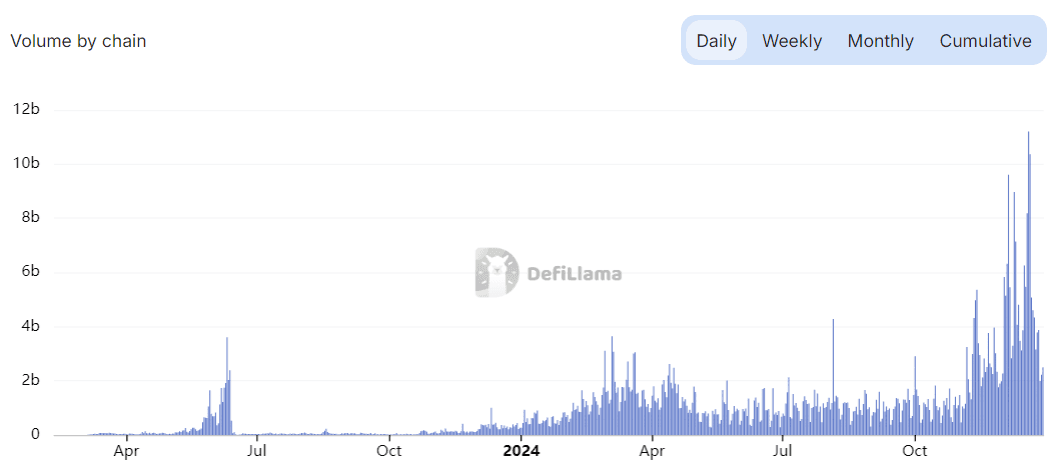

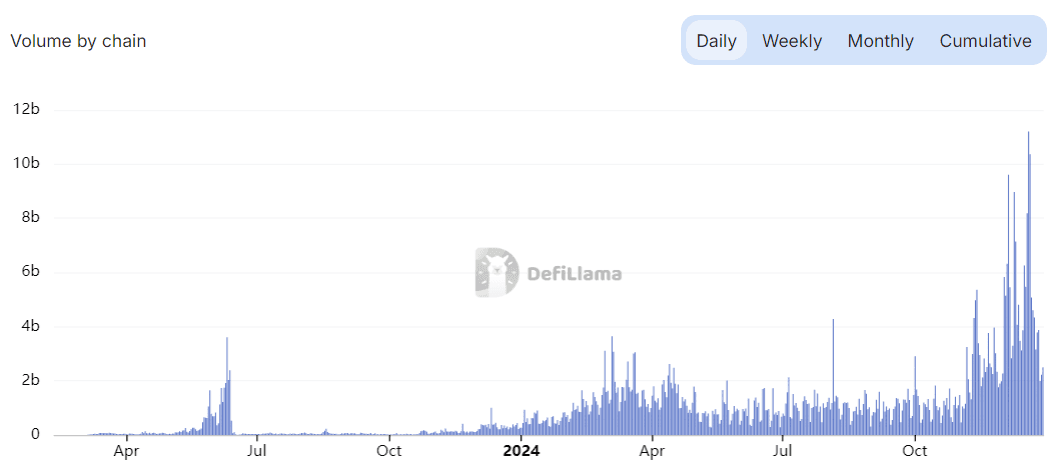

Hyperliquid perpetual trading volume chart from Defillama

The introduction of the vault system was a paradigm shifting event in the perpetual derivatives space. It made capital more efficient and allowed listing on multiple coins without fragmentating liquidity.

Hyperliquid Vault is a native primitive built into the Hyperliquid chain, which allows the protocol to use capital from other users for trading and market making activities on the exchange. Market makers have always been the key in providing liquidity on centralized exchanges. Through the vault system, Hyperliquid not only introduced market-making capabilities to decentralized exchanges but also democratized it by enabling users to participate in the processes.

With the vault system, the owner of the vault has the authority to use the deposited capital for trading on the exchange but cannot withdraw or transfer it to another account. This design creates yield-generating opportunities while safeguarding capital from malicious actors. Beyond improving liquidity on the exchange, this mechanism also opened avenues for non-traders to earn passive income from their capital. Just in the month of December 2024, Hyperliquid’s HLP vault has an APR of over 30%.

The vaults on Hyperliquid are categorized into two primary types:

Hyperliquidity Provider (HLP) Vault

HLP is the primary vault of the Hyperliquid protocol and it’s responsible for market-making and liquidation operations on the exchange. It enables community members to provide liquidity and earn a share of the profits generated from various market making activities.

The vault enhances liquidity on the exchange by placing opposing trades to user orders. For example, if a user wants to long 1 BTC on the Hyperliquid exchange, it would typically require a third-party market maker or another trader willing to take the short position to fulfill the order. However, the HLP Vault steps in as the market maker, placing the corresponding short trade for 1 BTC. This allows the vault to fill the order directly and distribute the resulting profits (if any) back to liquidity providers.

Since HLP is run by Hyperledger itself, the vault does not have any additional charge and operates as a community-owned product. However, there is a 4-days lock-up period for all the liquidity deposited into the vault.

Community Vaults

These vaults are created and managed by individual traders who implement their own trading strategies using their fund and other user funds. Hyperliquid provides LPs with the details on who controls the vault and their APR return. LPs can then choose a vault that matches their risk appetite and deposit their capital. The trader controlling the vault receives 10% share of the profit as compensation for their vault management and strategy. Unlike HLP vaults, Community vaults only have a 1-day lock-in period, offering more flexibility to liquidity providers.

Hyperliquidity Provider (HLP) VaultCommunity VaultsManagementOperated by HyperliquidOperated by individual tradersCommission0%10% of profitStrategy Acts as market maker and carries out liquidationRelies on the strategies of the vault ownerLock-In period4 Days1 Day

Vault users are divided into two categories:

Vault Leaders:

Any user on Hyperledger can create their own community vault.All they need to do is name the vault, write a description, and deposit a minimum of 100 USDC of their own capital. However, once the vault starts to grow in capital, the vault leader is required to maintain a minimum of 5% of the total capital in the vault. This mechanism ensures that the vault leader always has a large stake in the vault’s performance. When the vault executes a successful trade, the vault leader earns a 10% commission from the profits generated for the vault’s depositors.

Vault Depositor:

Any user who deposits capital into a vault is considered a Vault Depositor. Depositors are entitled to a share of the vault’s profits proportional to their contribution. For example, if Adam deposits $1,000 to a vault that already had $9,000, he will own 10% of the vault. If the vault makes a 100% profit and grows to $20,000 then Adam would have made a $900 in profit ($1,000 in overall profit minus the 10% commission to the vault leader). However, if the vault loses 20% of its value and reaches $8,000 then Adam’s share of the vault will also drop to $800.

The leaders also have the ability to close their vaults, but they must first ensure that all open trades are settled before doing so. Once a vault is closed, all the depositors will receive their share of the vault back into their account.

On the other hand, if depositors were to withdraw their funds while vault trades are still active, Hyperledger will check if the vault has enough remaining capital to keep the positions open. If not, a proportional amount of all open positions will be automatically settled. For example, if a user withdraws 10% of the vault’s total deposits, 10% of all open positions would be closed upon that withdrawal

Hyperliquid’s platform governance is a testament to its commitment to decentralization and community involvement. The governance process is designed to be transparent and inclusive, allowing HYPE token holders to have meaningful input in the platform’s evolution.

Proposal Submission: Any user can submit proposals for changes to the platform, whether it’s updates to the consensus algorithm, tokenomics, or other features. This open submission process ensures that all voices can be heard.

Voting: HYPE token holders can vote on these proposals, with each token representing a vote. This democratic process ensures that the community has a direct impact on the platform’s future.

Implementation: Once a proposal is approved by the community, it is implemented by the platform’s development team, ensuring that the changes are executed efficiently and effectively.

The benefits of Hyperliquid’s governance model are manifold:

Decentralized Decision-Making: The governance process is decentralized, empowering users to participate in decision-making and ensuring that no single entity has undue control.

Community-Driven: The platform’s governance is driven by the community, ensuring that the needs and interests of users are prioritized.

Increased Security: By involving users in the governance process, the platform can adapt to emerging threats and challenges, enhancing its overall security.

This decentralized and community-driven governance model not only fosters a sense of ownership among users but also ensures that Hyperliquid remains a dynamic and resilient platform, capable of evolving with the needs of its community.

Hyperliquid's journey has been nothing short of extraordinary. From its boot-strapped beginnings to becoming the largest decentralized derivatives exchange, the project has continually pushed the boundaries of what’s possible with DeFi. With its revolutionary vault mechanism and cutting-edge L1 chain, Hyperliquid has set new standards for speed, liquidity, and capital efficiency in the crypto derivatives space.

The overwhelming success of the HYPE token launch and the exponential growth of Hyperliquid’s ecosystem shows the faith that the crypto community has in the project. Overall, Hyperliquid has firmly established itself as a major player in the DeFi space and the project is poised to become one of the biggest L1 chains of the Web3, with a clear focus on DeFi.

The past year saw several high profile token launches in the crypto space, but none have achieved the level of success or generated as much excitement as Hyperliquid’s HYPE token. HYPE conducted its airdrop and official launch in the final week of November before pulling in hundreds of millions in liquidity, backed by stablecoin. This article explores the Hyperliquid ecosystem with a particular focus on the vault mechanism which was responsible for its massive success.

Read more about the Hyperliquid launch

Hyperliquid was co-founded by Jeff Yan, a Harvard graduate with a background in quantitative trading. The core team members come from some of the top U.S. universities, including Harvard, MIT, and Caltech, many of whom had previous experience in high-frequency trading and quantitative finance.

Hyperliquid was bootstrapped by the team and this soon became one of its unique selling points at a time where most projects had large VC stakes. Lack of a large VCs meant that Hyperliquid could allocate a larger portoin of its tokens to the community which increased the community allotment and helped build loyalty over the brand.

The project launched its token in November 2024 and has been widely considered to be one of the best airdrops of this cycle. HYPE token currently trades at $28 and has a market cap of $9.3 billion and a fully diluted value of $28 billion.

Additionally, the Hyperliquid platform eliminates gas fees for transactions, enhancing transaction speed and efficiency for users engaging in decentralized perpetual futures trading.

Hyperliquid is well-known as the largest derivatives dex in Web3. It offers a trading experience comparable to that of a centralized exchange, featuring over 150 perpetual trading pairs on its platform. However, Hyperliquid is more than just an exchange, it’s also an L1 chain that’s optimized from the ground up for lightning-fast onchain trading.

Ever since its launch in December 2022, the project witnessed strong growth, quickly becoming the preferred platform for many perpetual traders. It has consistently offered more token pairs and higher liquidity than any of its competitors. In the first week of December 2024, the exchange had nearly $44 billion in trading volume which is 6 times the volume of the second biggest derivatives dex.

The Hyperliquid dex runs on the L1 chain with the same name. The Hyperliquid chain was built on Tendermint and supports over 100,000 transactions per second with a latency of less than 1 second. According to the Hyperliquid team, the L1 is capable of supporting an entire ecosystem of permissionless financial applications where every order, trade, and liquidation happens transparently on-chain. With such impressive stats, it’s no surprise that the chain has quickly built a thriving community of different financial platforms. The ecosystem includes user-built applications designed to interface seamlessly with native components, enhancing performance and user experience.

Source: Hyperliquid_Hub

The ecosystem currently includes multiple Dexes, lending platforms, infra projects, stablecoins, and even memecoins. At the time of this writing, there are nearly 20 different projects that are part of the Hyperliquid ecosystem and more are likely to join in the future.

Bridging to the Hyperliquid chain is a strightforward and seamless process. Currently, the chain supports the USDC token, which can be bridged from the Arbitrum network. Since deposits happen from Arbitrum, the transaction fees for bridging into and out of the Hyperliquid chain are exceptionally low, making it a cost-efficient option for users. The range of supported assets and chains are likely to expand in the future.

Hyperliquid’s custom consensus algorithm, HyperBFT, is a cornerstone of its robust and high-performance blockchain. Inspired by Hotstuff and its successors, HyperBFT is meticulously designed to provide rapid transaction finality and unparalleled security. This proprietary consensus algorithm ensures that every transaction on the Hyperliquid network is processed swiftly and securely, making it a reliable choice for users.

HyperBFT achieves several critical security goals:

Rapid Transaction Finality: Transactions are finalized quickly, minimizing the risk of forks and enhancing the overall security of the network.

Robust Security: The algorithm is fortified against various types of attacks, including 51% attacks and Sybil attacks, ensuring the network’s integrity.

High Performance: Optimized for high performance, HyperBFT supports fast transaction processing and scalability, accommodating a growing number of users and transactions.

In addition to the consensus algorithm, Hyperliquid employs a trusted validator set to participate in the consensus process, further ensuring the network’s integrity. Advanced cryptographic techniques secure all transactions, protecting user data and preventing unauthorized access. This combination of a custom consensus algorithm and stringent security measures makes Hyperliquid a secure and reliable platform for all its users.

Hyperliquid’s tokenomics are strategically designed to foster user participation and network growth. The HYPE token, the native cryptocurrency of the Hyperliquid network, plays a pivotal role in this ecosystem.

Circulating Supply: With a circulating supply of 330 million and a maximum supply of 1 billion tokens, HYPE is structured to balance availability and value.

Token Distribution: HYPE tokens are distributed through various channels, including staking, trading, and governance participation, ensuring widespread user engagement.

Staking: Users can stake their HYPE tokens to participate in the network’s consensus process, earning rewards for their contributions.

Trading: HYPE tokens are actively traded on multiple cryptocurrency exchanges, providing liquidity and opportunities for users to buy and sell the token.

Governance: HYPE token holders have a voice in the network’s governance, voting on proposals and influencing the platform’s future direction.

The incentives for participating in the Hyperliquid network are compelling:

Rewards: Users earn rewards for staking, trading, and contributing to the platform’s growth, making participation financially attractive.

Discounts: Active participants receive discounts on transaction fees and other platform services, enhancing their trading experience.

Increased Security: By engaging in the consensus process, users help bolster the platform’s security, protecting their assets and the network as a whole.

These well-thought-out tokenomics and incentives ensure that users are not only motivated to join the Hyperliquid network but also to remain active and engaged, driving the platform’s continuous growth and success.

In order to better understand the Hyperledger ecosystem, let’s first take a look at its flagship product, the Hyperliquid derivatives exchange.

In 2022, the vast majority of crypto derivatives trading happened on centralized platforms. Even though there were decentralized alternatives like dYdX and GMX, most traders preferred centralized alternatives due to their speed and higher liquidity. However, the collapse of FTX in November of that year forced many traders to look for decentralized alternatives. It was during this crucial time that Hyperliquid launched its exchange and became an instant hit.

To simplify the process of understanding HYPE's value, Hyperliquid offers a USD converter hype tool that allows users to convert HYPE tokens into USD.

The exchange’s phenomenal success can be attributed to the new vault mechanism, which greatly improves liquidity on the exchange by acting as a decentralized market maker. This mechanism enabled Hyperliquid to list more tokens with better liquidity than any of its counterparts. With the vault mechanism, Hyperliquid quickly became the no. 1 perp. Dex by daily trading volume.

Hyperliquid perpetual trading volume chart from Defillama

The introduction of the vault system was a paradigm shifting event in the perpetual derivatives space. It made capital more efficient and allowed listing on multiple coins without fragmentating liquidity.

Hyperliquid Vault is a native primitive built into the Hyperliquid chain, which allows the protocol to use capital from other users for trading and market making activities on the exchange. Market makers have always been the key in providing liquidity on centralized exchanges. Through the vault system, Hyperliquid not only introduced market-making capabilities to decentralized exchanges but also democratized it by enabling users to participate in the processes.

With the vault system, the owner of the vault has the authority to use the deposited capital for trading on the exchange but cannot withdraw or transfer it to another account. This design creates yield-generating opportunities while safeguarding capital from malicious actors. Beyond improving liquidity on the exchange, this mechanism also opened avenues for non-traders to earn passive income from their capital. Just in the month of December 2024, Hyperliquid’s HLP vault has an APR of over 30%.

The vaults on Hyperliquid are categorized into two primary types:

Hyperliquidity Provider (HLP) Vault

HLP is the primary vault of the Hyperliquid protocol and it’s responsible for market-making and liquidation operations on the exchange. It enables community members to provide liquidity and earn a share of the profits generated from various market making activities.

The vault enhances liquidity on the exchange by placing opposing trades to user orders. For example, if a user wants to long 1 BTC on the Hyperliquid exchange, it would typically require a third-party market maker or another trader willing to take the short position to fulfill the order. However, the HLP Vault steps in as the market maker, placing the corresponding short trade for 1 BTC. This allows the vault to fill the order directly and distribute the resulting profits (if any) back to liquidity providers.

Since HLP is run by Hyperledger itself, the vault does not have any additional charge and operates as a community-owned product. However, there is a 4-days lock-up period for all the liquidity deposited into the vault.

Community Vaults

These vaults are created and managed by individual traders who implement their own trading strategies using their fund and other user funds. Hyperliquid provides LPs with the details on who controls the vault and their APR return. LPs can then choose a vault that matches their risk appetite and deposit their capital. The trader controlling the vault receives 10% share of the profit as compensation for their vault management and strategy. Unlike HLP vaults, Community vaults only have a 1-day lock-in period, offering more flexibility to liquidity providers.

Hyperliquidity Provider (HLP) VaultCommunity VaultsManagementOperated by HyperliquidOperated by individual tradersCommission0%10% of profitStrategy Acts as market maker and carries out liquidationRelies on the strategies of the vault ownerLock-In period4 Days1 Day

Vault users are divided into two categories:

Vault Leaders:

Any user on Hyperledger can create their own community vault.All they need to do is name the vault, write a description, and deposit a minimum of 100 USDC of their own capital. However, once the vault starts to grow in capital, the vault leader is required to maintain a minimum of 5% of the total capital in the vault. This mechanism ensures that the vault leader always has a large stake in the vault’s performance. When the vault executes a successful trade, the vault leader earns a 10% commission from the profits generated for the vault’s depositors.

Vault Depositor:

Any user who deposits capital into a vault is considered a Vault Depositor. Depositors are entitled to a share of the vault’s profits proportional to their contribution. For example, if Adam deposits $1,000 to a vault that already had $9,000, he will own 10% of the vault. If the vault makes a 100% profit and grows to $20,000 then Adam would have made a $900 in profit ($1,000 in overall profit minus the 10% commission to the vault leader). However, if the vault loses 20% of its value and reaches $8,000 then Adam’s share of the vault will also drop to $800.

The leaders also have the ability to close their vaults, but they must first ensure that all open trades are settled before doing so. Once a vault is closed, all the depositors will receive their share of the vault back into their account.

On the other hand, if depositors were to withdraw their funds while vault trades are still active, Hyperledger will check if the vault has enough remaining capital to keep the positions open. If not, a proportional amount of all open positions will be automatically settled. For example, if a user withdraws 10% of the vault’s total deposits, 10% of all open positions would be closed upon that withdrawal

Hyperliquid’s platform governance is a testament to its commitment to decentralization and community involvement. The governance process is designed to be transparent and inclusive, allowing HYPE token holders to have meaningful input in the platform’s evolution.

Proposal Submission: Any user can submit proposals for changes to the platform, whether it’s updates to the consensus algorithm, tokenomics, or other features. This open submission process ensures that all voices can be heard.

Voting: HYPE token holders can vote on these proposals, with each token representing a vote. This democratic process ensures that the community has a direct impact on the platform’s future.

Implementation: Once a proposal is approved by the community, it is implemented by the platform’s development team, ensuring that the changes are executed efficiently and effectively.

The benefits of Hyperliquid’s governance model are manifold:

Decentralized Decision-Making: The governance process is decentralized, empowering users to participate in decision-making and ensuring that no single entity has undue control.

Community-Driven: The platform’s governance is driven by the community, ensuring that the needs and interests of users are prioritized.

Increased Security: By involving users in the governance process, the platform can adapt to emerging threats and challenges, enhancing its overall security.

This decentralized and community-driven governance model not only fosters a sense of ownership among users but also ensures that Hyperliquid remains a dynamic and resilient platform, capable of evolving with the needs of its community.

Hyperliquid's journey has been nothing short of extraordinary. From its boot-strapped beginnings to becoming the largest decentralized derivatives exchange, the project has continually pushed the boundaries of what’s possible with DeFi. With its revolutionary vault mechanism and cutting-edge L1 chain, Hyperliquid has set new standards for speed, liquidity, and capital efficiency in the crypto derivatives space.

The overwhelming success of the HYPE token launch and the exponential growth of Hyperliquid’s ecosystem shows the faith that the crypto community has in the project. Overall, Hyperliquid has firmly established itself as a major player in the DeFi space and the project is poised to become one of the biggest L1 chains of the Web3, with a clear focus on DeFi.

The past year saw several high profile token launches in the crypto space, but none have achieved the level of success or generated as much excitement as Hyperliquid’s HYPE token. HYPE conducted its airdrop and official launch in the final week of November before pulling in hundreds of millions in liquidity, backed by stablecoin. This article explores the Hyperliquid ecosystem with a particular focus on the vault mechanism which was responsible for its massive success.

Read more about the Hyperliquid launch

Hyperliquid was co-founded by Jeff Yan, a Harvard graduate with a background in quantitative trading. The core team members come from some of the top U.S. universities, including Harvard, MIT, and Caltech, many of whom had previous experience in high-frequency trading and quantitative finance.

Hyperliquid was bootstrapped by the team and this soon became one of its unique selling points at a time where most projects had large VC stakes. Lack of a large VCs meant that Hyperliquid could allocate a larger portoin of its tokens to the community which increased the community allotment and helped build loyalty over the brand.

The project launched its token in November 2024 and has been widely considered to be one of the best airdrops of this cycle. HYPE token currently trades at $28 and has a market cap of $9.3 billion and a fully diluted value of $28 billion.

Additionally, the Hyperliquid platform eliminates gas fees for transactions, enhancing transaction speed and efficiency for users engaging in decentralized perpetual futures trading.

Hyperliquid is well-known as the largest derivatives dex in Web3. It offers a trading experience comparable to that of a centralized exchange, featuring over 150 perpetual trading pairs on its platform. However, Hyperliquid is more than just an exchange, it’s also an L1 chain that’s optimized from the ground up for lightning-fast onchain trading.

Ever since its launch in December 2022, the project witnessed strong growth, quickly becoming the preferred platform for many perpetual traders. It has consistently offered more token pairs and higher liquidity than any of its competitors. In the first week of December 2024, the exchange had nearly $44 billion in trading volume which is 6 times the volume of the second biggest derivatives dex.

The Hyperliquid dex runs on the L1 chain with the same name. The Hyperliquid chain was built on Tendermint and supports over 100,000 transactions per second with a latency of less than 1 second. According to the Hyperliquid team, the L1 is capable of supporting an entire ecosystem of permissionless financial applications where every order, trade, and liquidation happens transparently on-chain. With such impressive stats, it’s no surprise that the chain has quickly built a thriving community of different financial platforms. The ecosystem includes user-built applications designed to interface seamlessly with native components, enhancing performance and user experience.

Source: Hyperliquid_Hub

The ecosystem currently includes multiple Dexes, lending platforms, infra projects, stablecoins, and even memecoins. At the time of this writing, there are nearly 20 different projects that are part of the Hyperliquid ecosystem and more are likely to join in the future.

Bridging to the Hyperliquid chain is a strightforward and seamless process. Currently, the chain supports the USDC token, which can be bridged from the Arbitrum network. Since deposits happen from Arbitrum, the transaction fees for bridging into and out of the Hyperliquid chain are exceptionally low, making it a cost-efficient option for users. The range of supported assets and chains are likely to expand in the future.

Hyperliquid’s custom consensus algorithm, HyperBFT, is a cornerstone of its robust and high-performance blockchain. Inspired by Hotstuff and its successors, HyperBFT is meticulously designed to provide rapid transaction finality and unparalleled security. This proprietary consensus algorithm ensures that every transaction on the Hyperliquid network is processed swiftly and securely, making it a reliable choice for users.

HyperBFT achieves several critical security goals:

Rapid Transaction Finality: Transactions are finalized quickly, minimizing the risk of forks and enhancing the overall security of the network.

Robust Security: The algorithm is fortified against various types of attacks, including 51% attacks and Sybil attacks, ensuring the network’s integrity.

High Performance: Optimized for high performance, HyperBFT supports fast transaction processing and scalability, accommodating a growing number of users and transactions.

In addition to the consensus algorithm, Hyperliquid employs a trusted validator set to participate in the consensus process, further ensuring the network’s integrity. Advanced cryptographic techniques secure all transactions, protecting user data and preventing unauthorized access. This combination of a custom consensus algorithm and stringent security measures makes Hyperliquid a secure and reliable platform for all its users.

Hyperliquid’s tokenomics are strategically designed to foster user participation and network growth. The HYPE token, the native cryptocurrency of the Hyperliquid network, plays a pivotal role in this ecosystem.

Circulating Supply: With a circulating supply of 330 million and a maximum supply of 1 billion tokens, HYPE is structured to balance availability and value.

Token Distribution: HYPE tokens are distributed through various channels, including staking, trading, and governance participation, ensuring widespread user engagement.

Staking: Users can stake their HYPE tokens to participate in the network’s consensus process, earning rewards for their contributions.

Trading: HYPE tokens are actively traded on multiple cryptocurrency exchanges, providing liquidity and opportunities for users to buy and sell the token.

Governance: HYPE token holders have a voice in the network’s governance, voting on proposals and influencing the platform’s future direction.

The incentives for participating in the Hyperliquid network are compelling:

Rewards: Users earn rewards for staking, trading, and contributing to the platform’s growth, making participation financially attractive.

Discounts: Active participants receive discounts on transaction fees and other platform services, enhancing their trading experience.

Increased Security: By engaging in the consensus process, users help bolster the platform’s security, protecting their assets and the network as a whole.

These well-thought-out tokenomics and incentives ensure that users are not only motivated to join the Hyperliquid network but also to remain active and engaged, driving the platform’s continuous growth and success.

In order to better understand the Hyperledger ecosystem, let’s first take a look at its flagship product, the Hyperliquid derivatives exchange.

In 2022, the vast majority of crypto derivatives trading happened on centralized platforms. Even though there were decentralized alternatives like dYdX and GMX, most traders preferred centralized alternatives due to their speed and higher liquidity. However, the collapse of FTX in November of that year forced many traders to look for decentralized alternatives. It was during this crucial time that Hyperliquid launched its exchange and became an instant hit.

To simplify the process of understanding HYPE's value, Hyperliquid offers a USD converter hype tool that allows users to convert HYPE tokens into USD.

The exchange’s phenomenal success can be attributed to the new vault mechanism, which greatly improves liquidity on the exchange by acting as a decentralized market maker. This mechanism enabled Hyperliquid to list more tokens with better liquidity than any of its counterparts. With the vault mechanism, Hyperliquid quickly became the no. 1 perp. Dex by daily trading volume.

Hyperliquid perpetual trading volume chart from Defillama

The introduction of the vault system was a paradigm shifting event in the perpetual derivatives space. It made capital more efficient and allowed listing on multiple coins without fragmentating liquidity.

Hyperliquid Vault is a native primitive built into the Hyperliquid chain, which allows the protocol to use capital from other users for trading and market making activities on the exchange. Market makers have always been the key in providing liquidity on centralized exchanges. Through the vault system, Hyperliquid not only introduced market-making capabilities to decentralized exchanges but also democratized it by enabling users to participate in the processes.

With the vault system, the owner of the vault has the authority to use the deposited capital for trading on the exchange but cannot withdraw or transfer it to another account. This design creates yield-generating opportunities while safeguarding capital from malicious actors. Beyond improving liquidity on the exchange, this mechanism also opened avenues for non-traders to earn passive income from their capital. Just in the month of December 2024, Hyperliquid’s HLP vault has an APR of over 30%.

The vaults on Hyperliquid are categorized into two primary types:

Hyperliquidity Provider (HLP) Vault

HLP is the primary vault of the Hyperliquid protocol and it’s responsible for market-making and liquidation operations on the exchange. It enables community members to provide liquidity and earn a share of the profits generated from various market making activities.

The vault enhances liquidity on the exchange by placing opposing trades to user orders. For example, if a user wants to long 1 BTC on the Hyperliquid exchange, it would typically require a third-party market maker or another trader willing to take the short position to fulfill the order. However, the HLP Vault steps in as the market maker, placing the corresponding short trade for 1 BTC. This allows the vault to fill the order directly and distribute the resulting profits (if any) back to liquidity providers.

Since HLP is run by Hyperledger itself, the vault does not have any additional charge and operates as a community-owned product. However, there is a 4-days lock-up period for all the liquidity deposited into the vault.

Community Vaults

These vaults are created and managed by individual traders who implement their own trading strategies using their fund and other user funds. Hyperliquid provides LPs with the details on who controls the vault and their APR return. LPs can then choose a vault that matches their risk appetite and deposit their capital. The trader controlling the vault receives 10% share of the profit as compensation for their vault management and strategy. Unlike HLP vaults, Community vaults only have a 1-day lock-in period, offering more flexibility to liquidity providers.

Hyperliquidity Provider (HLP) VaultCommunity VaultsManagementOperated by HyperliquidOperated by individual tradersCommission0%10% of profitStrategy Acts as market maker and carries out liquidationRelies on the strategies of the vault ownerLock-In period4 Days1 Day

Vault users are divided into two categories:

Vault Leaders:

Any user on Hyperledger can create their own community vault.All they need to do is name the vault, write a description, and deposit a minimum of 100 USDC of their own capital. However, once the vault starts to grow in capital, the vault leader is required to maintain a minimum of 5% of the total capital in the vault. This mechanism ensures that the vault leader always has a large stake in the vault’s performance. When the vault executes a successful trade, the vault leader earns a 10% commission from the profits generated for the vault’s depositors.

Vault Depositor:

Any user who deposits capital into a vault is considered a Vault Depositor. Depositors are entitled to a share of the vault’s profits proportional to their contribution. For example, if Adam deposits $1,000 to a vault that already had $9,000, he will own 10% of the vault. If the vault makes a 100% profit and grows to $20,000 then Adam would have made a $900 in profit ($1,000 in overall profit minus the 10% commission to the vault leader). However, if the vault loses 20% of its value and reaches $8,000 then Adam’s share of the vault will also drop to $800.

The leaders also have the ability to close their vaults, but they must first ensure that all open trades are settled before doing so. Once a vault is closed, all the depositors will receive their share of the vault back into their account.

On the other hand, if depositors were to withdraw their funds while vault trades are still active, Hyperledger will check if the vault has enough remaining capital to keep the positions open. If not, a proportional amount of all open positions will be automatically settled. For example, if a user withdraws 10% of the vault’s total deposits, 10% of all open positions would be closed upon that withdrawal

Hyperliquid’s platform governance is a testament to its commitment to decentralization and community involvement. The governance process is designed to be transparent and inclusive, allowing HYPE token holders to have meaningful input in the platform’s evolution.

Proposal Submission: Any user can submit proposals for changes to the platform, whether it’s updates to the consensus algorithm, tokenomics, or other features. This open submission process ensures that all voices can be heard.

Voting: HYPE token holders can vote on these proposals, with each token representing a vote. This democratic process ensures that the community has a direct impact on the platform’s future.

Implementation: Once a proposal is approved by the community, it is implemented by the platform’s development team, ensuring that the changes are executed efficiently and effectively.

The benefits of Hyperliquid’s governance model are manifold:

Decentralized Decision-Making: The governance process is decentralized, empowering users to participate in decision-making and ensuring that no single entity has undue control.

Community-Driven: The platform’s governance is driven by the community, ensuring that the needs and interests of users are prioritized.

Increased Security: By involving users in the governance process, the platform can adapt to emerging threats and challenges, enhancing its overall security.

This decentralized and community-driven governance model not only fosters a sense of ownership among users but also ensures that Hyperliquid remains a dynamic and resilient platform, capable of evolving with the needs of its community.

Hyperliquid's journey has been nothing short of extraordinary. From its boot-strapped beginnings to becoming the largest decentralized derivatives exchange, the project has continually pushed the boundaries of what’s possible with DeFi. With its revolutionary vault mechanism and cutting-edge L1 chain, Hyperliquid has set new standards for speed, liquidity, and capital efficiency in the crypto derivatives space.

The overwhelming success of the HYPE token launch and the exponential growth of Hyperliquid’s ecosystem shows the faith that the crypto community has in the project. Overall, Hyperliquid has firmly established itself as a major player in the DeFi space and the project is poised to become one of the biggest L1 chains of the Web3, with a clear focus on DeFi.

Share this article

Related Articles

Related Articles

Related Articles