DeFi

Jan 1, 2025

DeFi

DeFi

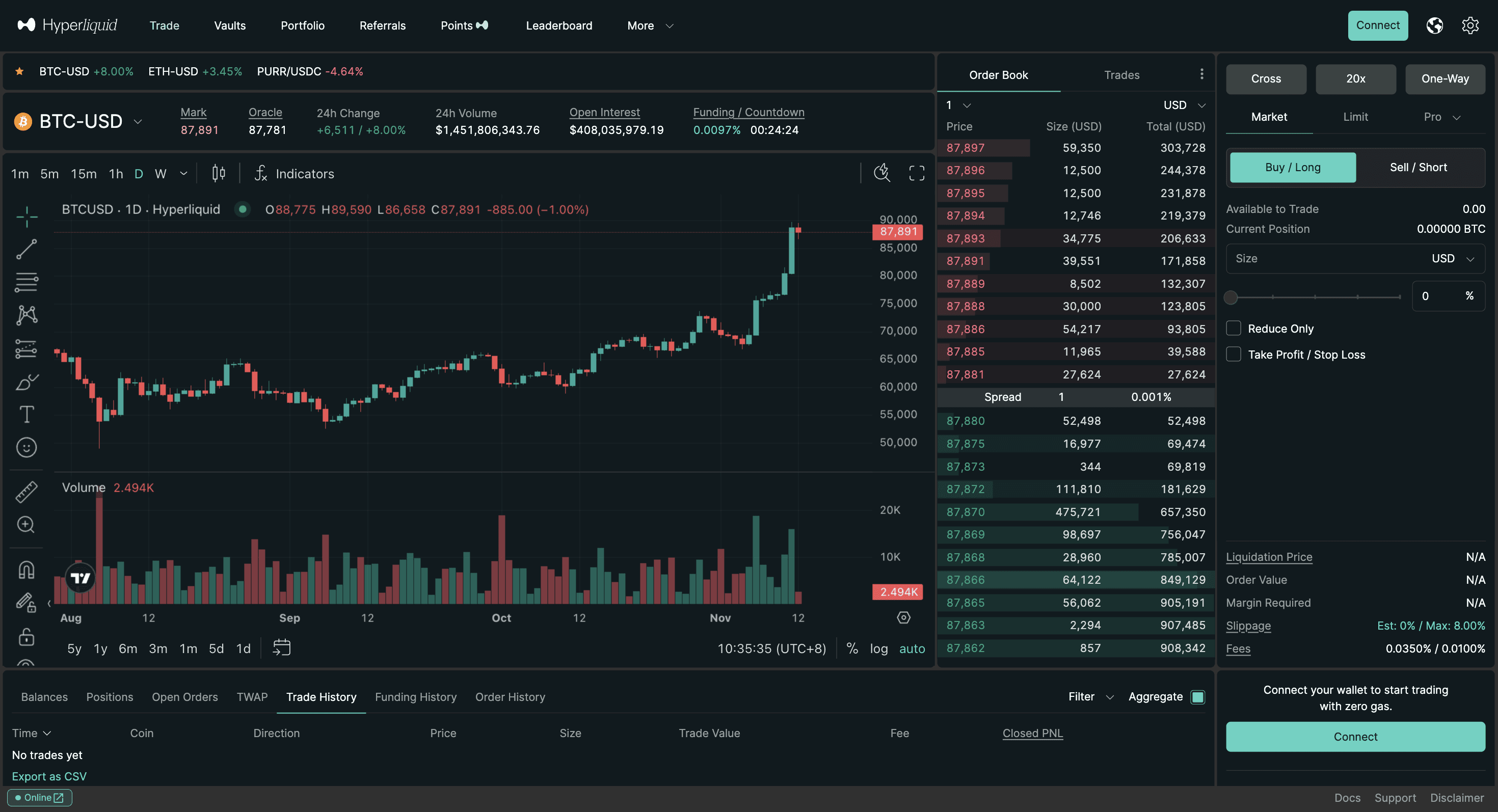

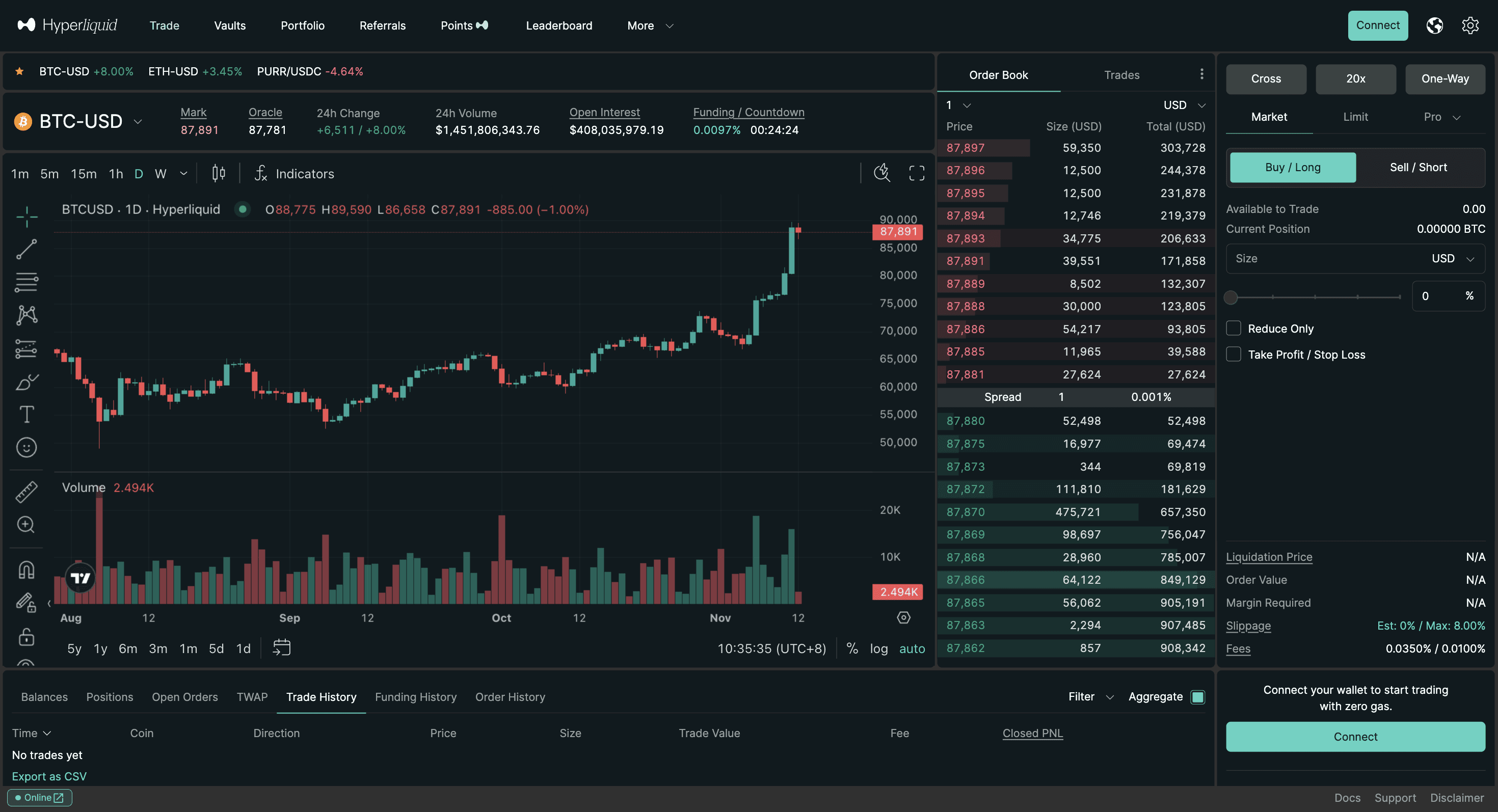

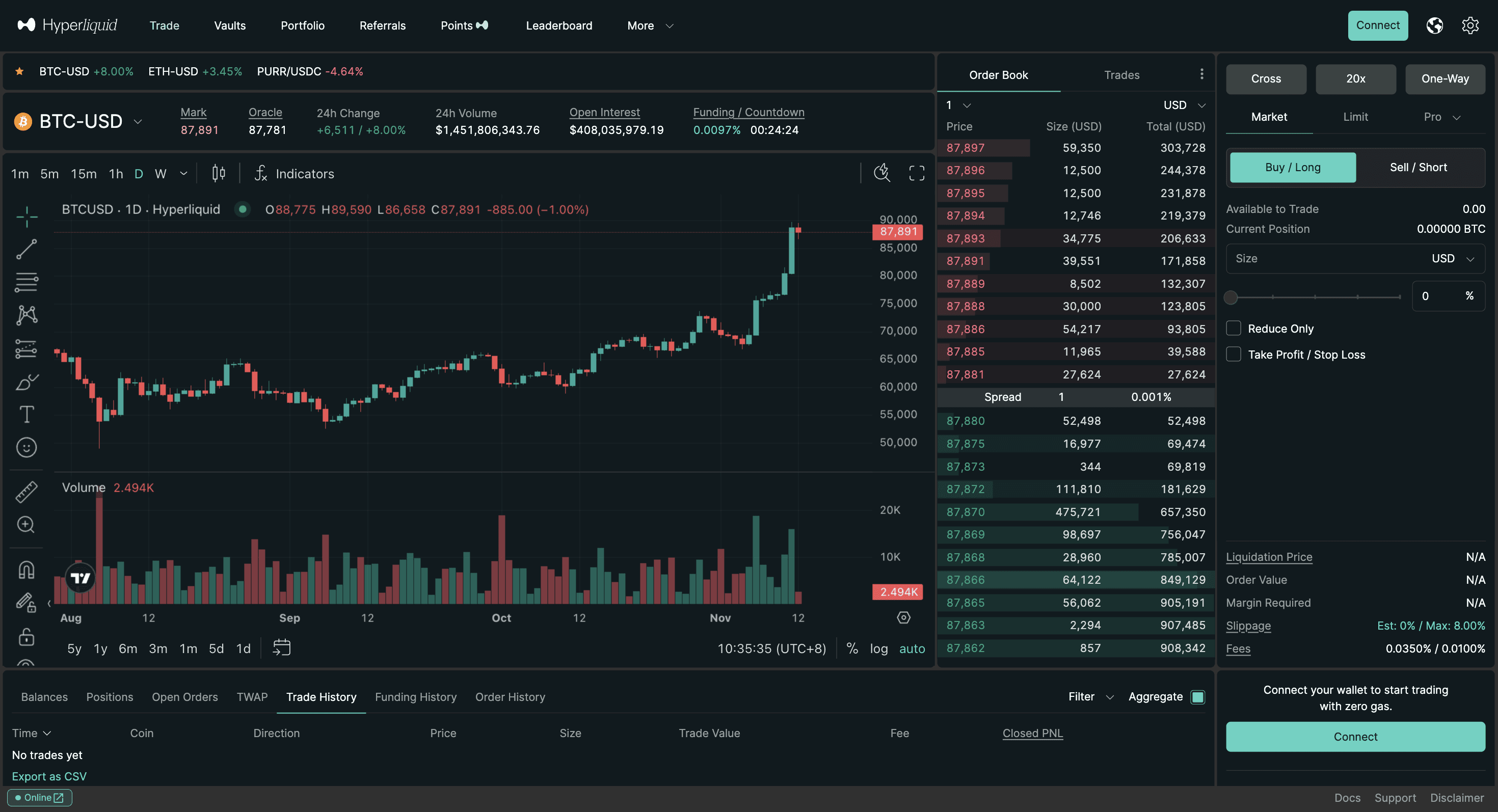

Photo by: hyperfoundation.org

HyperLiquid is a recently launched decentralized layer 1 project. Its flagship offering is a decentralized perpetual swap platform with a fully on-chain order book that requires no gas fees after depositing. The protocol is powered by a custom-designed consensus protocol known as HyperBFT, which enhances scalability and security.

The exchange also provides spot trading and other functionalities including permissionless liquidity. HyperLiquid claims it can process 100K orders per second.

The network airdropped its native token “HYPE” to 94000 wallets last Friday. About 31% of the supply has been earmarked for the airdrop to ensure sufficient decentralization.

While traditional centralized exchanges offer better UX design and advanced market order settings, decentralized protocols suffer from low liquidity and complex navigation.

HyperLiquid tries to solve this bottleneck by offering all the features of a centralized exchange in a decentralized protocol. Some of the main features of HyperLiquid include:

The backend runs on an EVM network secured by a set of validators for the Layer 1 HyperLiquid network. Validators can also cross-check and verify oracle prices sourced from multiple order books.

Users will need an EVM-compatible wallet, USDC on Arbitrum as collateral, and ETH to begin trading.

Traders can deploy the Arbitrum bridge, use Squid, or deposit Arbitrum from a centralized exchange. USDC is used as collateral on HyperLiquid.

HyperLiquid offers several types of orders such as market, limit, stop limit, stop market, and scale. Scale orders allow users to set up several limit orders in different price ranges.

However, experts have pointed out that HyperLiquid’s increasing reliance on the Arbitrum bridge could result in security issues due to potential bugs in smart contracts. Moreover, the layer 1 blockchain of HyperLiquid has not been battle-tested in real trading scenarios as yet.

HyperLiquid uses price oracles that provide data and any potential failure could also lead to complications for the protocol. HyperLiquid claims to have taken sufficient mitigation measures to reduce such risks and provide a smooth trading experience for its users.

HyperLiquid also experienced an issue with chain overloading in the past but refunded all users after adjusting its price discovery formula. It caused automatic liquidations that would not have occurred otherwise.

Perpetual contracts have grown in popularity and offer a unique trading proposition for users by offering leverage. The total market has surpassed $60 trillion since 2020 and it will be exciting to see DeFi trading platforms like HyperLiquid seek to address challenges in mass DeFi adoption and how much of that market can be taken by Web3.

HyperLiquid is a recently launched decentralized layer 1 project. Its flagship offering is a decentralized perpetual swap platform with a fully on-chain order book that requires no gas fees after depositing. The protocol is powered by a custom-designed consensus protocol known as HyperBFT, which enhances scalability and security.

The exchange also provides spot trading and other functionalities including permissionless liquidity. HyperLiquid claims it can process 100K orders per second.

The network airdropped its native token “HYPE” to 94000 wallets last Friday. About 31% of the supply has been earmarked for the airdrop to ensure sufficient decentralization.

While traditional centralized exchanges offer better UX design and advanced market order settings, decentralized protocols suffer from low liquidity and complex navigation.

HyperLiquid tries to solve this bottleneck by offering all the features of a centralized exchange in a decentralized protocol. Some of the main features of HyperLiquid include:

The backend runs on an EVM network secured by a set of validators for the Layer 1 HyperLiquid network. Validators can also cross-check and verify oracle prices sourced from multiple order books.

Users will need an EVM-compatible wallet, USDC on Arbitrum as collateral, and ETH to begin trading.

Traders can deploy the Arbitrum bridge, use Squid, or deposit Arbitrum from a centralized exchange. USDC is used as collateral on HyperLiquid.

HyperLiquid offers several types of orders such as market, limit, stop limit, stop market, and scale. Scale orders allow users to set up several limit orders in different price ranges.

However, experts have pointed out that HyperLiquid’s increasing reliance on the Arbitrum bridge could result in security issues due to potential bugs in smart contracts. Moreover, the layer 1 blockchain of HyperLiquid has not been battle-tested in real trading scenarios as yet.

HyperLiquid uses price oracles that provide data and any potential failure could also lead to complications for the protocol. HyperLiquid claims to have taken sufficient mitigation measures to reduce such risks and provide a smooth trading experience for its users.

HyperLiquid also experienced an issue with chain overloading in the past but refunded all users after adjusting its price discovery formula. It caused automatic liquidations that would not have occurred otherwise.

Perpetual contracts have grown in popularity and offer a unique trading proposition for users by offering leverage. The total market has surpassed $60 trillion since 2020 and it will be exciting to see DeFi trading platforms like HyperLiquid seek to address challenges in mass DeFi adoption and how much of that market can be taken by Web3.

HyperLiquid is a recently launched decentralized layer 1 project. Its flagship offering is a decentralized perpetual swap platform with a fully on-chain order book that requires no gas fees after depositing. The protocol is powered by a custom-designed consensus protocol known as HyperBFT, which enhances scalability and security.

The exchange also provides spot trading and other functionalities including permissionless liquidity. HyperLiquid claims it can process 100K orders per second.

The network airdropped its native token “HYPE” to 94000 wallets last Friday. About 31% of the supply has been earmarked for the airdrop to ensure sufficient decentralization.

While traditional centralized exchanges offer better UX design and advanced market order settings, decentralized protocols suffer from low liquidity and complex navigation.

HyperLiquid tries to solve this bottleneck by offering all the features of a centralized exchange in a decentralized protocol. Some of the main features of HyperLiquid include:

The backend runs on an EVM network secured by a set of validators for the Layer 1 HyperLiquid network. Validators can also cross-check and verify oracle prices sourced from multiple order books.

Users will need an EVM-compatible wallet, USDC on Arbitrum as collateral, and ETH to begin trading.

Traders can deploy the Arbitrum bridge, use Squid, or deposit Arbitrum from a centralized exchange. USDC is used as collateral on HyperLiquid.

HyperLiquid offers several types of orders such as market, limit, stop limit, stop market, and scale. Scale orders allow users to set up several limit orders in different price ranges.

However, experts have pointed out that HyperLiquid’s increasing reliance on the Arbitrum bridge could result in security issues due to potential bugs in smart contracts. Moreover, the layer 1 blockchain of HyperLiquid has not been battle-tested in real trading scenarios as yet.

HyperLiquid uses price oracles that provide data and any potential failure could also lead to complications for the protocol. HyperLiquid claims to have taken sufficient mitigation measures to reduce such risks and provide a smooth trading experience for its users.

HyperLiquid also experienced an issue with chain overloading in the past but refunded all users after adjusting its price discovery formula. It caused automatic liquidations that would not have occurred otherwise.

Perpetual contracts have grown in popularity and offer a unique trading proposition for users by offering leverage. The total market has surpassed $60 trillion since 2020 and it will be exciting to see DeFi trading platforms like HyperLiquid seek to address challenges in mass DeFi adoption and how much of that market can be taken by Web3.

Share this article

Related Articles

Related Articles

Related Articles