Industry News

Jan 28, 2025

Industry News

Industry News

The crypto market witnessed a groundbreaking month in November as trading volumes on centralized exchanges skyrocketed to an unprecedented $10 trillion. That staggering figure marks the highest trading volume ever recorded for digital assets, reflecting a surge of enthusiasm among retail and institutional traders alike.

According to CCData, combined trading volume has more than doubled from October. A wave of optimism about the possibility of pro-crypto policies under the newly elected Trump administration drove this meteoric rise. Bitcoin, the leading cryptocurrency, has seen a 38% increase in price, nearly breaching $100,000.

“Optimism is also evident on the institutional side, with CME volumes seeing a significant uptick and substantial inflows into spot Bitcoin ETFs over the past month,” remarked Jacob Joseph, a senior research analyst at CCData.

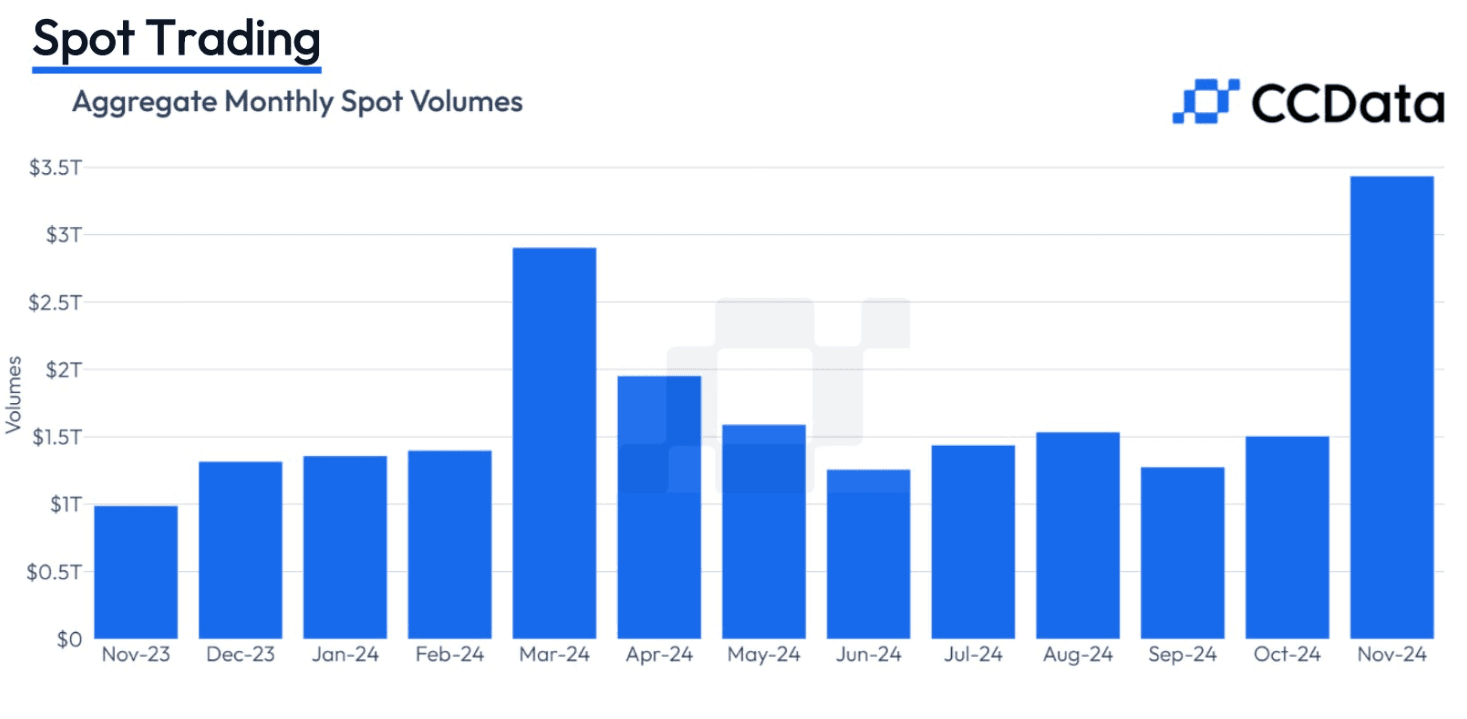

Centralized exchanges (CEX) experienced remarkable growth in November. Monthly spot trading volumes surged 128% to $3.43 trillion, the second-highest monthly figure since May 2021. Derivatives trading also saw a record-breaking rise, climbing 89% to $6.99 trillion and surpassing the previous peak set in March.

Source: CCData

This surge was particularly evident in South Korea, where exchanges like Upbit reported significant activity in altcoin trading. The institutional market also saw substantial growth, with the CME exchange’s aggregate trading volume jumping 83% to $245 billion—an all-time high for the platform.

November’s $10 trillion milestone was achieved amid shifting market sentiment following the U.S. presidential election. The win by Donald Trump bolstered hopes for a favorable regulatory framework, driving investors and traders to capitalize on the positive momentum in digital asset prices.

The derivatives market played a crucial role in November’s historic surge. Crypto derivatives volumes saw a month-over-month increase of nearly 90%, reaching almost $7 trillion. The launch of new platforms and products also contributed to this growth. On Nov. 6, Arkham launched a digital asset derivatives exchange targeting retail traders, adding competition to established platforms like Binance.

Exchanges began listing options on Bitcoin exchange-traded funds (ETFs) in November after the U.S. Securities and Exchange Commission approved them in September. Notably, options contracts on BlackRock’s BTC ETF recorded nearly $2 billion in exposure on their first day of trading, Nov. 18.

Investment managers are optimistic about the impact of BTC ETF options on institutional adoption. They believe this development could unlock extraordinary upside potential for Bitcoin holders, as options grant traders the flexibility to buy or sell at predetermined prices, amplifying trading strategies.

Ripple effects of November Trading Frenzy spread around the world. Exchanges like Bybit, Crypto.com, Gate.io, and Bullish all saw all-time highs in monthly trading volumes. The growth wasn't confined just to a few regions or platforms, underscoring the widespread excitement during the month.

Crypto firms' shares also joined in the rally: Stock in Galaxy Digital, one of the largest crypto trading desks, surged 25% on Nov. 5 in its biggest trading day of the year. The surge came after the historic Trump's election win, and served to further underline the strong connection between market sentiment and political events.

While the report from CCData did not include the decentralized finance (DeFi) space, the boom in November was mainly for centralized exchanges and institutional platforms, meaning such sectors are very dominant in leading the market.

The crypto market witnessed a groundbreaking month in November as trading volumes on centralized exchanges skyrocketed to an unprecedented $10 trillion. That staggering figure marks the highest trading volume ever recorded for digital assets, reflecting a surge of enthusiasm among retail and institutional traders alike.

According to CCData, combined trading volume has more than doubled from October. A wave of optimism about the possibility of pro-crypto policies under the newly elected Trump administration drove this meteoric rise. Bitcoin, the leading cryptocurrency, has seen a 38% increase in price, nearly breaching $100,000.

“Optimism is also evident on the institutional side, with CME volumes seeing a significant uptick and substantial inflows into spot Bitcoin ETFs over the past month,” remarked Jacob Joseph, a senior research analyst at CCData.

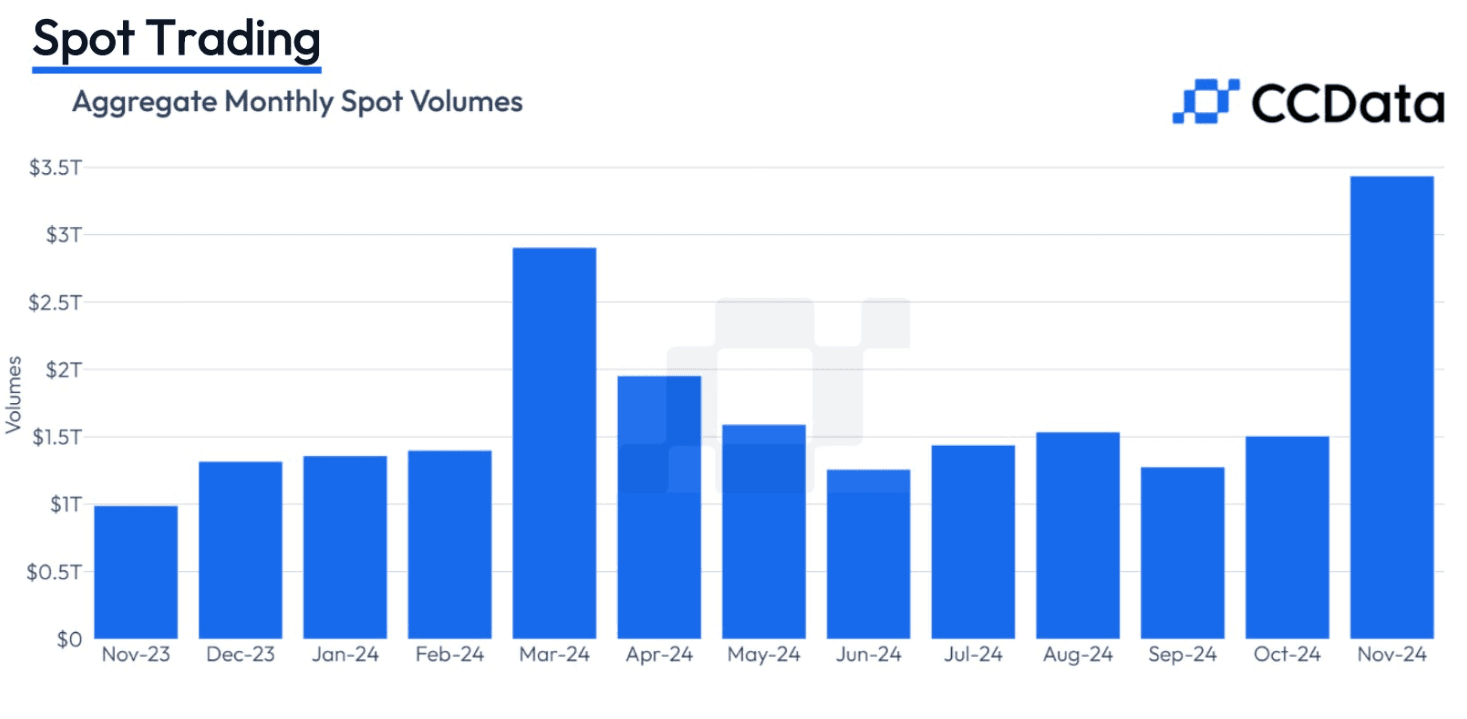

Centralized exchanges (CEX) experienced remarkable growth in November. Monthly spot trading volumes surged 128% to $3.43 trillion, the second-highest monthly figure since May 2021. Derivatives trading also saw a record-breaking rise, climbing 89% to $6.99 trillion and surpassing the previous peak set in March.

Source: CCData

This surge was particularly evident in South Korea, where exchanges like Upbit reported significant activity in altcoin trading. The institutional market also saw substantial growth, with the CME exchange’s aggregate trading volume jumping 83% to $245 billion—an all-time high for the platform.

November’s $10 trillion milestone was achieved amid shifting market sentiment following the U.S. presidential election. The win by Donald Trump bolstered hopes for a favorable regulatory framework, driving investors and traders to capitalize on the positive momentum in digital asset prices.

The derivatives market played a crucial role in November’s historic surge. Crypto derivatives volumes saw a month-over-month increase of nearly 90%, reaching almost $7 trillion. The launch of new platforms and products also contributed to this growth. On Nov. 6, Arkham launched a digital asset derivatives exchange targeting retail traders, adding competition to established platforms like Binance.

Exchanges began listing options on Bitcoin exchange-traded funds (ETFs) in November after the U.S. Securities and Exchange Commission approved them in September. Notably, options contracts on BlackRock’s BTC ETF recorded nearly $2 billion in exposure on their first day of trading, Nov. 18.

Investment managers are optimistic about the impact of BTC ETF options on institutional adoption. They believe this development could unlock extraordinary upside potential for Bitcoin holders, as options grant traders the flexibility to buy or sell at predetermined prices, amplifying trading strategies.

Ripple effects of November Trading Frenzy spread around the world. Exchanges like Bybit, Crypto.com, Gate.io, and Bullish all saw all-time highs in monthly trading volumes. The growth wasn't confined just to a few regions or platforms, underscoring the widespread excitement during the month.

Crypto firms' shares also joined in the rally: Stock in Galaxy Digital, one of the largest crypto trading desks, surged 25% on Nov. 5 in its biggest trading day of the year. The surge came after the historic Trump's election win, and served to further underline the strong connection between market sentiment and political events.

While the report from CCData did not include the decentralized finance (DeFi) space, the boom in November was mainly for centralized exchanges and institutional platforms, meaning such sectors are very dominant in leading the market.

The crypto market witnessed a groundbreaking month in November as trading volumes on centralized exchanges skyrocketed to an unprecedented $10 trillion. That staggering figure marks the highest trading volume ever recorded for digital assets, reflecting a surge of enthusiasm among retail and institutional traders alike.

According to CCData, combined trading volume has more than doubled from October. A wave of optimism about the possibility of pro-crypto policies under the newly elected Trump administration drove this meteoric rise. Bitcoin, the leading cryptocurrency, has seen a 38% increase in price, nearly breaching $100,000.

“Optimism is also evident on the institutional side, with CME volumes seeing a significant uptick and substantial inflows into spot Bitcoin ETFs over the past month,” remarked Jacob Joseph, a senior research analyst at CCData.

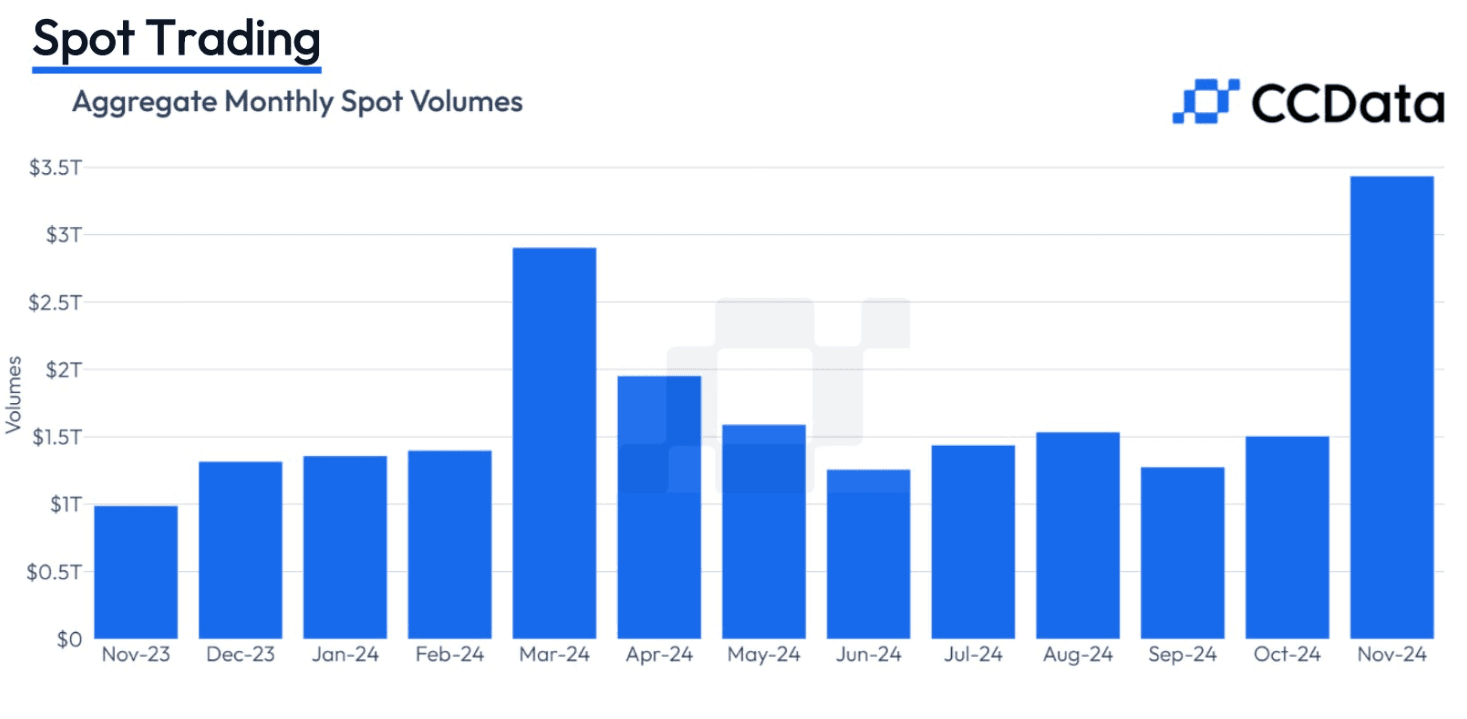

Centralized exchanges (CEX) experienced remarkable growth in November. Monthly spot trading volumes surged 128% to $3.43 trillion, the second-highest monthly figure since May 2021. Derivatives trading also saw a record-breaking rise, climbing 89% to $6.99 trillion and surpassing the previous peak set in March.

Source: CCData

This surge was particularly evident in South Korea, where exchanges like Upbit reported significant activity in altcoin trading. The institutional market also saw substantial growth, with the CME exchange’s aggregate trading volume jumping 83% to $245 billion—an all-time high for the platform.

November’s $10 trillion milestone was achieved amid shifting market sentiment following the U.S. presidential election. The win by Donald Trump bolstered hopes for a favorable regulatory framework, driving investors and traders to capitalize on the positive momentum in digital asset prices.

The derivatives market played a crucial role in November’s historic surge. Crypto derivatives volumes saw a month-over-month increase of nearly 90%, reaching almost $7 trillion. The launch of new platforms and products also contributed to this growth. On Nov. 6, Arkham launched a digital asset derivatives exchange targeting retail traders, adding competition to established platforms like Binance.

Exchanges began listing options on Bitcoin exchange-traded funds (ETFs) in November after the U.S. Securities and Exchange Commission approved them in September. Notably, options contracts on BlackRock’s BTC ETF recorded nearly $2 billion in exposure on their first day of trading, Nov. 18.

Investment managers are optimistic about the impact of BTC ETF options on institutional adoption. They believe this development could unlock extraordinary upside potential for Bitcoin holders, as options grant traders the flexibility to buy or sell at predetermined prices, amplifying trading strategies.

Ripple effects of November Trading Frenzy spread around the world. Exchanges like Bybit, Crypto.com, Gate.io, and Bullish all saw all-time highs in monthly trading volumes. The growth wasn't confined just to a few regions or platforms, underscoring the widespread excitement during the month.

Crypto firms' shares also joined in the rally: Stock in Galaxy Digital, one of the largest crypto trading desks, surged 25% on Nov. 5 in its biggest trading day of the year. The surge came after the historic Trump's election win, and served to further underline the strong connection between market sentiment and political events.

While the report from CCData did not include the decentralized finance (DeFi) space, the boom in November was mainly for centralized exchanges and institutional platforms, meaning such sectors are very dominant in leading the market.

Share this article

Related Articles

Related Articles

Related Articles