Digital Ownership

Dec 27, 2024

Digital Ownership

Digital Ownership

Photo by: cottonbro studio on pexels

Hybrid NFTs are a breakthrough innovation in the digital innovation landscape. They simplify digital ownership benefits and interoperability by combining the best of ERC-20 (fungible tokens) and ERC-721 (typical NFTs). Learn more about hybrid NFTs and how industries can utilize them!

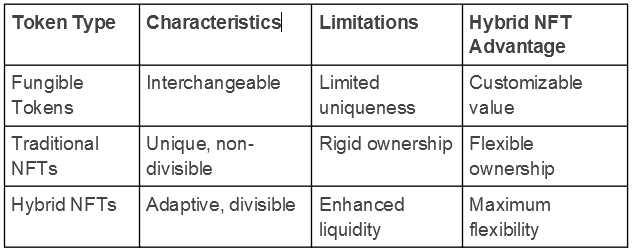

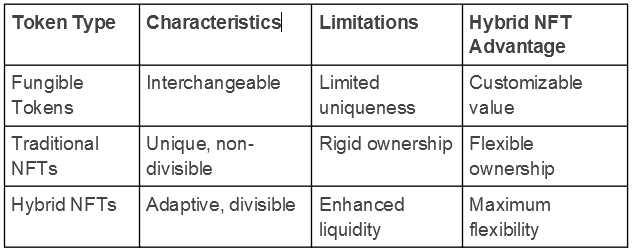

As their name suggests, hybrid NFTs are a mix of fungible and non-fungible tokens. While most people picture these digital assets as static images from the first wave of NFTs popularized during the 2021 pandemic, these hybrid tokens store dynamic, updateable values that adapt over time to various conditions and use cases.

Blend of Fungible and Non-Fungible Properties

Hybrid NFTs combine the interchangeable aspects of fungible tokens with the uniqueness of non-fungible tokens.

Dynamic Utility Programming

Hybrid NFTs support programmable utilities that change based on conditions or usage, such as unlocking features.

Enhanced Interactivity

These NFTs foster engagement between creators and holders, simplifying features like voting rights, content collaboration, or real-time updates.

Cross-Asset Integration

Hybrid NFTs can link multiple assets, either digital and physical, into a unified token system for unified management.

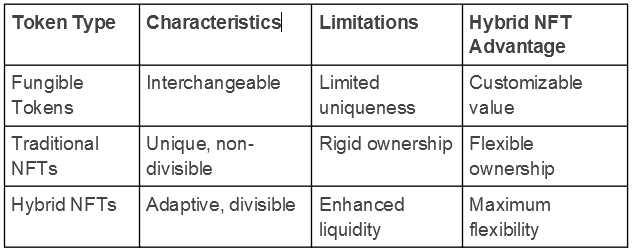

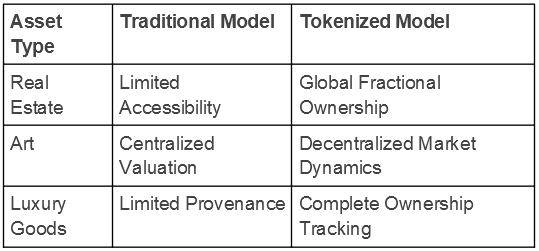

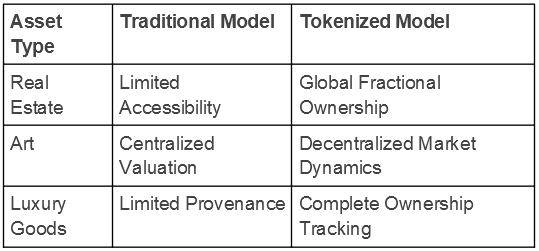

The table below illustrates how hybrid NFTs provide greater flexibility and liquidity compared to traditional NFTs and fungible tokens.

Hybrid NFTs unlock increased liquidity by:

Allowing partial token ownership

Creating more dynamic trading mechanisms

Reducing entry barriers for investors

These tokens revolutionize community interaction by:

Enabling collaborative ownership models

Creating interactive collector experiences

Developing deeper connection between creators and collectors

Hybrid NFTs introduce exciting engagement strategies:

Reward mechanisms for token holders

Interactive collectible experiences

Dynamic value appreciation models

Projects leverage hybrid NFTs to:

Generate ongoing revenue streams

Create multi-tiered monetization strategies

Develop long-term economic ecosystems

While promising, hybrid NFTs face several challenges:

High volatility in emerging markets, such as blockchain gaming cryptocurrency

Evolving investor perceptions

Complex valuation mechanisms

Complex blockchain integration

Advanced smart contract requirements

Emerging legal frameworks

Cross-border regulatory complexities

Need for comprehensive compliance strategies

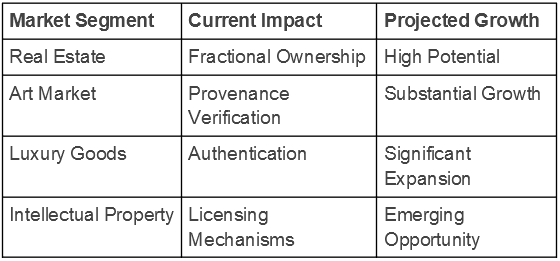

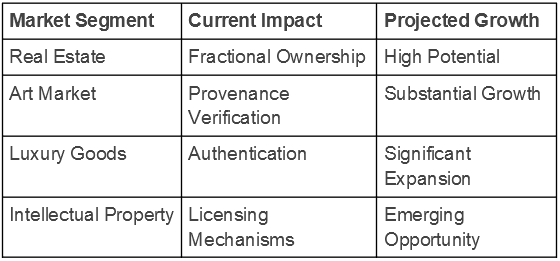

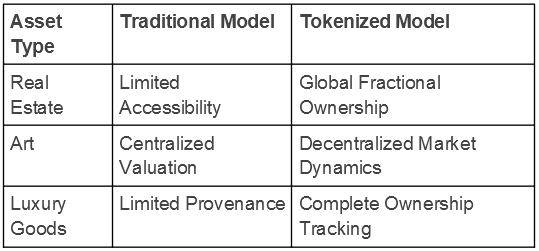

Web3 real estate innovations like hybrid tokens democratize property investment by:

Allowing micro-investments in prime properties

Reducing minimum investment thresholds

Enabling global real estate participation

Creating liquid property investment vehicles

Learn more about tokenized real estate

Digital tokens are transforming art markets through:

Verifiable artwork provenance

Fractional art ownership

Direct artist-to-collector engagement

Transparent transaction histories

Luxury brands leverage hybrid tokens to:

Authenticate exclusive merchandise

Create digital twins of physical products

Enable unique customer experiences

Track product lifecycle and ownership

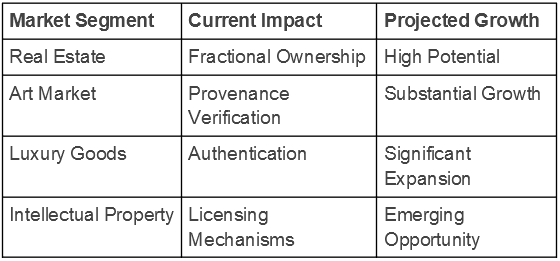

Tokenization unlocks previously illiquid assets, enabling:

Faster transaction speeds

Lower transaction costs

Global market access, like enabling small investors to participate in previously inaccessible high-value markets like real estate

Reduced intermediary dependencies, thanks to on-chain verification

Blockchain provides unparalleled authentication through:

Permanent ownership records

Tamper-proof transaction histories

Transparent asset lineage

Reduced fraud potential

Convergence creates unprecedented opportunities by:

Generating new revenue streams

Democratizing investment landscapes

Reducing entry barriers

Enabling innovative business models

Blockchain technology creates the fundamental infrastructure that enables hybrid NFTs to exist. This decentralized ledger system provides an immutable, transparent framework for digital asset representation, ensuring secure and verifiable ownership across digital and physical domains. The technology transcends traditional transactional models by introducing a revolutionary approach to asset verification and transfer.

Smart contracts serve as the intelligent core of hybrid NFT ecosystems. These self-executing code segments automate complex ownership rules, transforming how digital and physical assets interact. They create sophisticated mechanisms for managing ownership, enabling dynamic asset representation and seamless transaction protocols that adapt to complex market requirements.

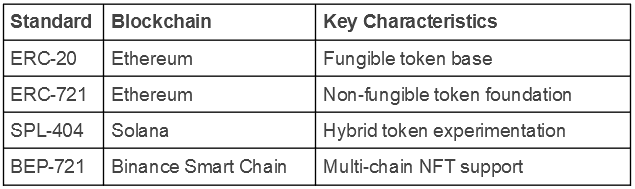

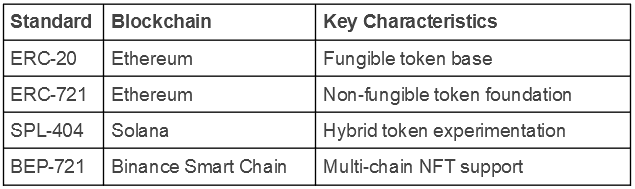

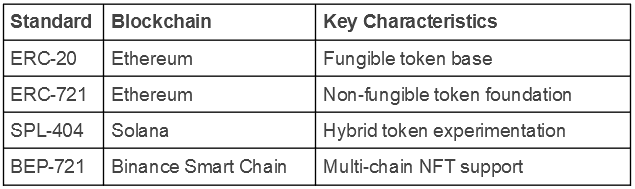

The evolution of NFT token standards represents a critical technological advancement in hybrid asset management. Different blockchain ecosystems have developed unique standards to support hybrid NFT functionalities, each offering distinct capabilities for asset tokenization.

Hybrid NFTs are dramatically transforming DeFi landscapes by introducing sophisticated financial mechanisms. They create innovative pathways for liquidity generation, enabling investors to mobilize assets across previously disconnected financial ecosystems. These tokens generate new investment strategies that combine the stability of traditional assets with the flexibility of digital instruments.

The technological framework supporting hybrid NFTs involves intricate layers of cryptographic security, distributed consensus mechanisms, and advanced token engineering. These technologies work in concert to create a robust infrastructure that can represent complex asset ownership models with unprecedented precision and transparency.

Modern hybrid NFT technologies focus intensely on creating seamless cross-chain communication protocols. They develop unified authentication mechanisms that allow assets to move fluidly between different blockchain ecosystems, breaking down traditional technological barriers and creating more accessible, flexible digital asset markets.

While promising, hybrid NFT technologies continue to navigate significant technological challenges. Scalability limitations, complex computational requirements, and regulatory compliance complexities remain ongoing areas of technological development. The blockchain community responds by continuously refining technological frameworks, developing more efficient consensus mechanisms, and creating more adaptable token standards.

Emerging technological trends suggest hybrid NFTs will become increasingly sophisticated. Future developments point towards more computationally efficient systems, more complex asset representations, and deeper integration with artificial intelligence technologies. These advancements promise to transform how we understand and interact with digital and physical assets.

The NFT market has undergone a remarkable transformation since its initial emergence. From speculative digital art collections to sophisticated asset representation systems, hybrid NFTs represent the next frontier of digital economic innovation. Market analysts observe a significant shift from purely digital collectibles to more complex, utility-driven token ecosystems that bridge physical and digital realms.

Institutional interest in hybrid NFTs continues to grow exponentially. Major financial institutions and technology companies recognize the potential of tokenized assets as a revolutionary approach to ownership and investment. The market demonstrates increasing sophistication, moving beyond initial speculative phases to more strategic, value-driven token implementations.

The hybrid NFT market shows promising indicators of sustained growth. Emerging technologies and changing investor perspectives create unprecedented opportunities for asset tokenization. Traditional markets are witnessing a gradual but significant transformation, with hybrid NFTs offering more flexible, accessible investment mechanisms.

Blockchain technology, combining with traditional markets, represents a base economic shift. Hybrid NFTs are the bridge between legacy financial systems and digital economies: they open the stage for highly transparent, low transaction cost approaches and dynamic asset management methods.

Hybrid NFT technologies evolve rapidly, overtaking governmental and financial regulators in keeping up with the prospective regulatory framework. Governments and financial regulators around the world are developing integrated approaches, such as Singapore's framework for digital asset taxation and regulation, to address the complexity of tokenized assets. The main challenges are:

Developing clear legal definitions for hybrid asset classifications

Creating robust consumer protection mechanisms

Establishing standardized taxation protocols

Ensuring comprehensive anti-money laundering compliance

The widespread adoption of hybrid NFTs depends significantly on consumer understanding and trust. Educational initiatives are crucial in demystifying the complex technological and economic mechanisms behind tokenized assets. Financial institutions and technology companies are investing heavily in creating accessible, user-friendly platforms that simplify hybrid NFT interactions.

Hybrid NFTs emerge as a powerful bridge between digital and physical asset ecosystems. They democratize ownership, enhance transparency, and create unprecedented flexibility in how we conceptualize, trade, and manage assets. The technology integrates sophisticated blockchain mechanisms, smart contract innovations, and advanced tokenization strategies to unlock new economic possibilities.

Hybrid NFTs represent more than a technological trend. They are a profound statement about the future of ownership, value, and economic interaction. As we move forward, these technologies will continue to reshape our understanding of assets, breaking down traditional barriers and creating more inclusive, transparent economic ecosystems.

Hybrid NFTs are a breakthrough innovation in the digital innovation landscape. They simplify digital ownership benefits and interoperability by combining the best of ERC-20 (fungible tokens) and ERC-721 (typical NFTs). Learn more about hybrid NFTs and how industries can utilize them!

As their name suggests, hybrid NFTs are a mix of fungible and non-fungible tokens. While most people picture these digital assets as static images from the first wave of NFTs popularized during the 2021 pandemic, these hybrid tokens store dynamic, updateable values that adapt over time to various conditions and use cases.

Blend of Fungible and Non-Fungible Properties

Hybrid NFTs combine the interchangeable aspects of fungible tokens with the uniqueness of non-fungible tokens.

Dynamic Utility Programming

Hybrid NFTs support programmable utilities that change based on conditions or usage, such as unlocking features.

Enhanced Interactivity

These NFTs foster engagement between creators and holders, simplifying features like voting rights, content collaboration, or real-time updates.

Cross-Asset Integration

Hybrid NFTs can link multiple assets, either digital and physical, into a unified token system for unified management.

The table below illustrates how hybrid NFTs provide greater flexibility and liquidity compared to traditional NFTs and fungible tokens.

Hybrid NFTs unlock increased liquidity by:

Allowing partial token ownership

Creating more dynamic trading mechanisms

Reducing entry barriers for investors

These tokens revolutionize community interaction by:

Enabling collaborative ownership models

Creating interactive collector experiences

Developing deeper connection between creators and collectors

Hybrid NFTs introduce exciting engagement strategies:

Reward mechanisms for token holders

Interactive collectible experiences

Dynamic value appreciation models

Projects leverage hybrid NFTs to:

Generate ongoing revenue streams

Create multi-tiered monetization strategies

Develop long-term economic ecosystems

While promising, hybrid NFTs face several challenges:

High volatility in emerging markets, such as blockchain gaming cryptocurrency

Evolving investor perceptions

Complex valuation mechanisms

Complex blockchain integration

Advanced smart contract requirements

Emerging legal frameworks

Cross-border regulatory complexities

Need for comprehensive compliance strategies

Web3 real estate innovations like hybrid tokens democratize property investment by:

Allowing micro-investments in prime properties

Reducing minimum investment thresholds

Enabling global real estate participation

Creating liquid property investment vehicles

Learn more about tokenized real estate

Digital tokens are transforming art markets through:

Verifiable artwork provenance

Fractional art ownership

Direct artist-to-collector engagement

Transparent transaction histories

Luxury brands leverage hybrid tokens to:

Authenticate exclusive merchandise

Create digital twins of physical products

Enable unique customer experiences

Track product lifecycle and ownership

Tokenization unlocks previously illiquid assets, enabling:

Faster transaction speeds

Lower transaction costs

Global market access, like enabling small investors to participate in previously inaccessible high-value markets like real estate

Reduced intermediary dependencies, thanks to on-chain verification

Blockchain provides unparalleled authentication through:

Permanent ownership records

Tamper-proof transaction histories

Transparent asset lineage

Reduced fraud potential

Convergence creates unprecedented opportunities by:

Generating new revenue streams

Democratizing investment landscapes

Reducing entry barriers

Enabling innovative business models

Blockchain technology creates the fundamental infrastructure that enables hybrid NFTs to exist. This decentralized ledger system provides an immutable, transparent framework for digital asset representation, ensuring secure and verifiable ownership across digital and physical domains. The technology transcends traditional transactional models by introducing a revolutionary approach to asset verification and transfer.

Smart contracts serve as the intelligent core of hybrid NFT ecosystems. These self-executing code segments automate complex ownership rules, transforming how digital and physical assets interact. They create sophisticated mechanisms for managing ownership, enabling dynamic asset representation and seamless transaction protocols that adapt to complex market requirements.

The evolution of NFT token standards represents a critical technological advancement in hybrid asset management. Different blockchain ecosystems have developed unique standards to support hybrid NFT functionalities, each offering distinct capabilities for asset tokenization.

Hybrid NFTs are dramatically transforming DeFi landscapes by introducing sophisticated financial mechanisms. They create innovative pathways for liquidity generation, enabling investors to mobilize assets across previously disconnected financial ecosystems. These tokens generate new investment strategies that combine the stability of traditional assets with the flexibility of digital instruments.

The technological framework supporting hybrid NFTs involves intricate layers of cryptographic security, distributed consensus mechanisms, and advanced token engineering. These technologies work in concert to create a robust infrastructure that can represent complex asset ownership models with unprecedented precision and transparency.

Modern hybrid NFT technologies focus intensely on creating seamless cross-chain communication protocols. They develop unified authentication mechanisms that allow assets to move fluidly between different blockchain ecosystems, breaking down traditional technological barriers and creating more accessible, flexible digital asset markets.

While promising, hybrid NFT technologies continue to navigate significant technological challenges. Scalability limitations, complex computational requirements, and regulatory compliance complexities remain ongoing areas of technological development. The blockchain community responds by continuously refining technological frameworks, developing more efficient consensus mechanisms, and creating more adaptable token standards.

Emerging technological trends suggest hybrid NFTs will become increasingly sophisticated. Future developments point towards more computationally efficient systems, more complex asset representations, and deeper integration with artificial intelligence technologies. These advancements promise to transform how we understand and interact with digital and physical assets.

The NFT market has undergone a remarkable transformation since its initial emergence. From speculative digital art collections to sophisticated asset representation systems, hybrid NFTs represent the next frontier of digital economic innovation. Market analysts observe a significant shift from purely digital collectibles to more complex, utility-driven token ecosystems that bridge physical and digital realms.

Institutional interest in hybrid NFTs continues to grow exponentially. Major financial institutions and technology companies recognize the potential of tokenized assets as a revolutionary approach to ownership and investment. The market demonstrates increasing sophistication, moving beyond initial speculative phases to more strategic, value-driven token implementations.

The hybrid NFT market shows promising indicators of sustained growth. Emerging technologies and changing investor perspectives create unprecedented opportunities for asset tokenization. Traditional markets are witnessing a gradual but significant transformation, with hybrid NFTs offering more flexible, accessible investment mechanisms.

Blockchain technology, combining with traditional markets, represents a base economic shift. Hybrid NFTs are the bridge between legacy financial systems and digital economies: they open the stage for highly transparent, low transaction cost approaches and dynamic asset management methods.

Hybrid NFT technologies evolve rapidly, overtaking governmental and financial regulators in keeping up with the prospective regulatory framework. Governments and financial regulators around the world are developing integrated approaches, such as Singapore's framework for digital asset taxation and regulation, to address the complexity of tokenized assets. The main challenges are:

Developing clear legal definitions for hybrid asset classifications

Creating robust consumer protection mechanisms

Establishing standardized taxation protocols

Ensuring comprehensive anti-money laundering compliance

The widespread adoption of hybrid NFTs depends significantly on consumer understanding and trust. Educational initiatives are crucial in demystifying the complex technological and economic mechanisms behind tokenized assets. Financial institutions and technology companies are investing heavily in creating accessible, user-friendly platforms that simplify hybrid NFT interactions.

Hybrid NFTs emerge as a powerful bridge between digital and physical asset ecosystems. They democratize ownership, enhance transparency, and create unprecedented flexibility in how we conceptualize, trade, and manage assets. The technology integrates sophisticated blockchain mechanisms, smart contract innovations, and advanced tokenization strategies to unlock new economic possibilities.

Hybrid NFTs represent more than a technological trend. They are a profound statement about the future of ownership, value, and economic interaction. As we move forward, these technologies will continue to reshape our understanding of assets, breaking down traditional barriers and creating more inclusive, transparent economic ecosystems.

Hybrid NFTs are a breakthrough innovation in the digital innovation landscape. They simplify digital ownership benefits and interoperability by combining the best of ERC-20 (fungible tokens) and ERC-721 (typical NFTs). Learn more about hybrid NFTs and how industries can utilize them!

As their name suggests, hybrid NFTs are a mix of fungible and non-fungible tokens. While most people picture these digital assets as static images from the first wave of NFTs popularized during the 2021 pandemic, these hybrid tokens store dynamic, updateable values that adapt over time to various conditions and use cases.

Blend of Fungible and Non-Fungible Properties

Hybrid NFTs combine the interchangeable aspects of fungible tokens with the uniqueness of non-fungible tokens.

Dynamic Utility Programming

Hybrid NFTs support programmable utilities that change based on conditions or usage, such as unlocking features.

Enhanced Interactivity

These NFTs foster engagement between creators and holders, simplifying features like voting rights, content collaboration, or real-time updates.

Cross-Asset Integration

Hybrid NFTs can link multiple assets, either digital and physical, into a unified token system for unified management.

The table below illustrates how hybrid NFTs provide greater flexibility and liquidity compared to traditional NFTs and fungible tokens.

Hybrid NFTs unlock increased liquidity by:

Allowing partial token ownership

Creating more dynamic trading mechanisms

Reducing entry barriers for investors

These tokens revolutionize community interaction by:

Enabling collaborative ownership models

Creating interactive collector experiences

Developing deeper connection between creators and collectors

Hybrid NFTs introduce exciting engagement strategies:

Reward mechanisms for token holders

Interactive collectible experiences

Dynamic value appreciation models

Projects leverage hybrid NFTs to:

Generate ongoing revenue streams

Create multi-tiered monetization strategies

Develop long-term economic ecosystems

While promising, hybrid NFTs face several challenges:

High volatility in emerging markets, such as blockchain gaming cryptocurrency

Evolving investor perceptions

Complex valuation mechanisms

Complex blockchain integration

Advanced smart contract requirements

Emerging legal frameworks

Cross-border regulatory complexities

Need for comprehensive compliance strategies

Web3 real estate innovations like hybrid tokens democratize property investment by:

Allowing micro-investments in prime properties

Reducing minimum investment thresholds

Enabling global real estate participation

Creating liquid property investment vehicles

Learn more about tokenized real estate

Digital tokens are transforming art markets through:

Verifiable artwork provenance

Fractional art ownership

Direct artist-to-collector engagement

Transparent transaction histories

Luxury brands leverage hybrid tokens to:

Authenticate exclusive merchandise

Create digital twins of physical products

Enable unique customer experiences

Track product lifecycle and ownership

Tokenization unlocks previously illiquid assets, enabling:

Faster transaction speeds

Lower transaction costs

Global market access, like enabling small investors to participate in previously inaccessible high-value markets like real estate

Reduced intermediary dependencies, thanks to on-chain verification

Blockchain provides unparalleled authentication through:

Permanent ownership records

Tamper-proof transaction histories

Transparent asset lineage

Reduced fraud potential

Convergence creates unprecedented opportunities by:

Generating new revenue streams

Democratizing investment landscapes

Reducing entry barriers

Enabling innovative business models

Blockchain technology creates the fundamental infrastructure that enables hybrid NFTs to exist. This decentralized ledger system provides an immutable, transparent framework for digital asset representation, ensuring secure and verifiable ownership across digital and physical domains. The technology transcends traditional transactional models by introducing a revolutionary approach to asset verification and transfer.

Smart contracts serve as the intelligent core of hybrid NFT ecosystems. These self-executing code segments automate complex ownership rules, transforming how digital and physical assets interact. They create sophisticated mechanisms for managing ownership, enabling dynamic asset representation and seamless transaction protocols that adapt to complex market requirements.

The evolution of NFT token standards represents a critical technological advancement in hybrid asset management. Different blockchain ecosystems have developed unique standards to support hybrid NFT functionalities, each offering distinct capabilities for asset tokenization.

Hybrid NFTs are dramatically transforming DeFi landscapes by introducing sophisticated financial mechanisms. They create innovative pathways for liquidity generation, enabling investors to mobilize assets across previously disconnected financial ecosystems. These tokens generate new investment strategies that combine the stability of traditional assets with the flexibility of digital instruments.

The technological framework supporting hybrid NFTs involves intricate layers of cryptographic security, distributed consensus mechanisms, and advanced token engineering. These technologies work in concert to create a robust infrastructure that can represent complex asset ownership models with unprecedented precision and transparency.

Modern hybrid NFT technologies focus intensely on creating seamless cross-chain communication protocols. They develop unified authentication mechanisms that allow assets to move fluidly between different blockchain ecosystems, breaking down traditional technological barriers and creating more accessible, flexible digital asset markets.

While promising, hybrid NFT technologies continue to navigate significant technological challenges. Scalability limitations, complex computational requirements, and regulatory compliance complexities remain ongoing areas of technological development. The blockchain community responds by continuously refining technological frameworks, developing more efficient consensus mechanisms, and creating more adaptable token standards.

Emerging technological trends suggest hybrid NFTs will become increasingly sophisticated. Future developments point towards more computationally efficient systems, more complex asset representations, and deeper integration with artificial intelligence technologies. These advancements promise to transform how we understand and interact with digital and physical assets.

The NFT market has undergone a remarkable transformation since its initial emergence. From speculative digital art collections to sophisticated asset representation systems, hybrid NFTs represent the next frontier of digital economic innovation. Market analysts observe a significant shift from purely digital collectibles to more complex, utility-driven token ecosystems that bridge physical and digital realms.

Institutional interest in hybrid NFTs continues to grow exponentially. Major financial institutions and technology companies recognize the potential of tokenized assets as a revolutionary approach to ownership and investment. The market demonstrates increasing sophistication, moving beyond initial speculative phases to more strategic, value-driven token implementations.

The hybrid NFT market shows promising indicators of sustained growth. Emerging technologies and changing investor perspectives create unprecedented opportunities for asset tokenization. Traditional markets are witnessing a gradual but significant transformation, with hybrid NFTs offering more flexible, accessible investment mechanisms.

Blockchain technology, combining with traditional markets, represents a base economic shift. Hybrid NFTs are the bridge between legacy financial systems and digital economies: they open the stage for highly transparent, low transaction cost approaches and dynamic asset management methods.

Hybrid NFT technologies evolve rapidly, overtaking governmental and financial regulators in keeping up with the prospective regulatory framework. Governments and financial regulators around the world are developing integrated approaches, such as Singapore's framework for digital asset taxation and regulation, to address the complexity of tokenized assets. The main challenges are:

Developing clear legal definitions for hybrid asset classifications

Creating robust consumer protection mechanisms

Establishing standardized taxation protocols

Ensuring comprehensive anti-money laundering compliance

The widespread adoption of hybrid NFTs depends significantly on consumer understanding and trust. Educational initiatives are crucial in demystifying the complex technological and economic mechanisms behind tokenized assets. Financial institutions and technology companies are investing heavily in creating accessible, user-friendly platforms that simplify hybrid NFT interactions.

Hybrid NFTs emerge as a powerful bridge between digital and physical asset ecosystems. They democratize ownership, enhance transparency, and create unprecedented flexibility in how we conceptualize, trade, and manage assets. The technology integrates sophisticated blockchain mechanisms, smart contract innovations, and advanced tokenization strategies to unlock new economic possibilities.

Hybrid NFTs represent more than a technological trend. They are a profound statement about the future of ownership, value, and economic interaction. As we move forward, these technologies will continue to reshape our understanding of assets, breaking down traditional barriers and creating more inclusive, transparent economic ecosystems.

Share this article

Related Articles

Related Articles

Related Articles